Page 266 - Bank-Muamalat-AR2020

P. 266

264 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

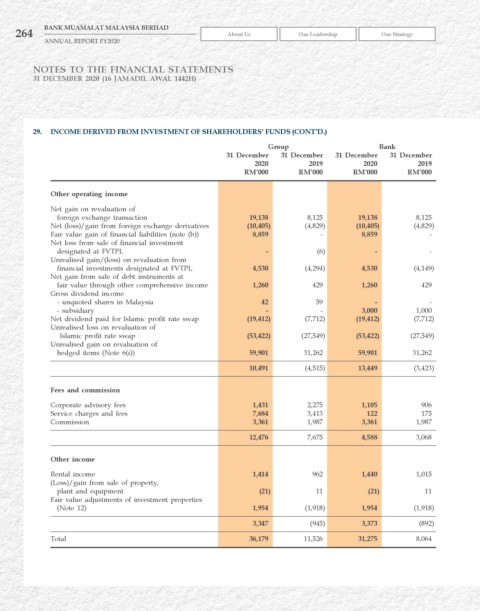

29. INCOME DErIvED FrOM INvESTMENT OF ShArEhOLDErS’ FuNDS (CONT’D.)

Group Bank

31 December 31 December 31 December 31 December

2020 2019 2020 2019

rM’000 rM’000 rM’000 rM’000

Other operating income

Net gain on revaluation of

foreign exchange transaction 19,138 8,125 19,138 8,125

Net (loss)/gain from foreign exchange derivatives (10,405) (4,829) (10,405) (4,829)

Fair value gain of financial liabilities (note (b)) 8,859 - 8,859 -

Net loss from sale of financial investment

designated at FVTPL - (6) - -

Unrealised gain/(loss) on revaluation from

financial investments designated at FVTPL 4,530 (4,294) 4,530 (4,149)

Net gain from sale of debt instruments at

fair value through other comprehensive income 1,260 429 1,260 429

Gross dividend income

- unquoted shares in Malaysia 42 59 - -

- subsidiary - - 3,000 1,000

Net dividend paid for Islamic profit rate swap (19,412) (7,712) (19,412) (7,712)

Unrealised loss on revaluation of

Islamic profit rate swap (53,422) (27,549) (53,422) (27,549)

Unrealised gain on revaluation of

hedged items (Note 6(i)) 59,901 31,262 59,901 31,262

10,491 (4,515) 13,449 (3,423)

Fees and commission

Corporate advisory fees 1,431 2,275 1,105 906

Service charges and fees 7,684 3,413 122 175

Commission 3,361 1,987 3,361 1,987

12,476 7,675 4,588 3,068

Other income

Rental income 1,414 962 1,440 1,015

(Loss)/gain from sale of property,

plant and equipment (21) 11 (21) 11

Fair value adjustments of investment properties

(Note 12) 1,954 (1,918) 1,954 (1,918)

3,347 (945) 3,373 (892)

Total 36,179 11,526 31,275 8,064