Page 93 - Bank-Muamalat_Annual-Report-2023

P. 93

ANNUAL REPORT 2023

SUSTAINABILITY STATEMENT

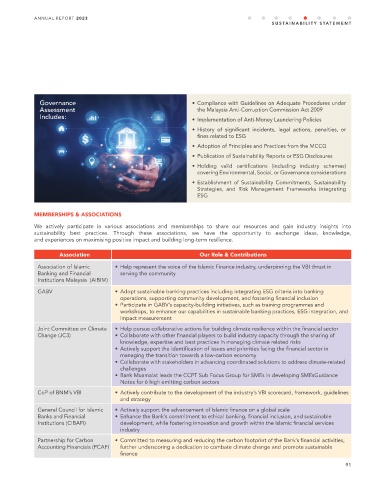

Governance • Compliance with Guidelines on Adequate Procedures under

Assessment the Malaysia Anti-Corruption Commission Act 2009

Includes:

• Implementation of Anti-Money Laundering Policies

• History of significant incidents, legal actions, penalties, or

fines related to ESG

• Adoption of Principles and Practices from the MCCG

• Publication of Sustainability Reports or ESG Disclosures

• Holding valid certifications (including industry schemes)

covering Environmental, Social, or Governance considerations

• Establishment of Sustainability Commitments, Sustainability

Strategies, and Risk Management Frameworks integrating

ESG

MEMBERSHIPS & ASSOCIATIONS

We actively participate in various associations and memberships to share our resources and gain industry insights into

sustainability best practices. Through these associations, we have the opportunity to exchange ideas, knowledge,

and experiences on maximising positive impact and building long-term resilience.

Association Our Role & Contributions

Association of Islamic • Help represent the voice of the Islamic Finance industry, underpinning the VBI thrust in

Banking and Financial serving the community

Institutions Malaysia (AIBIM)

GABV • Adopt sustainable banking practices including integrating ESG criteria into banking

operations, supporting community development, and fostering financial inclusion

• Participate in GABV’s capacity-building initiatives, such as training programmes and

workshops, to enhance our capabilities in sustainable banking practices, ESG integration, and

impact measurement

Joint Committee on Climate • Help pursue collaborative actions for building climate resilience within the financial sector

Change (JC3) • Collaborate with other financial players to build industry capacity through the sharing of

knowledge, expertise and best practices in managing climate related risks

• Actively support the identification of issues and priorities facing the financial sector in

managing the transition towards a low-carbon economy

• Collaborate with stakeholders in advancing coordinated solutions to address climate-related

challenges

• Bank Muamalat leads the CCPT Sub Focus Group for SMEs in developing SMEsGuidance

Notes for 6 high emitting carbon sectors

CoP of BNM’s VBI • Actively contribute to the development of the industry’s VBI scorecard, framework, guidelines

and strategy

General Council for Islamic • Actively support the advancement of Islamic finance on a global scale

Banks and Financial • Enhance the Bank’s commitment to ethical banking, financial inclusion, and sustainable

Institutions (CIBAFI) development, while fostering innovation and growth within the Islamic financial services

industry

Partnership for Carbon • Committed to measuring and reducing the carbon footprint of the Bank’s financial activities,

Accounting Financials (PCAF) further underscoring a dedication to combate climate change and promote sustainable

finance

91