Page 401 - Bank-Muamalat_Annual-Report-2023

P. 401

ANNUAL REPORT 2023

OUR NUMBERS

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

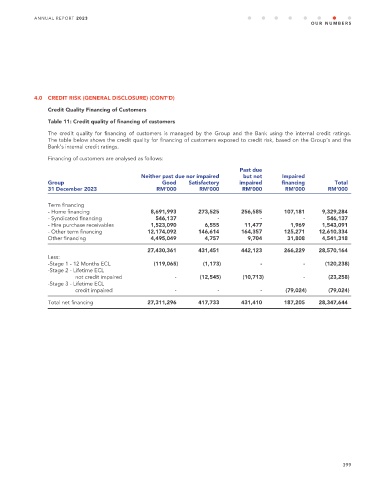

Credit Quality Financing of Customers

Table 11: Credit quality of financing of customers

The credit quality for financing of customers is managed by the Group and the Bank using the internal credit ratings.

The table below shows the credit quality for financing of customers exposed to credit risk, based on the Group’s and the

Bank’s internal credit ratings.

Financing of customers are analysed as follows:

Past due

Neither past due nor impaired but not Impaired

Group Good Satisfactory impaired financing Total

31 December 2023 RM’000 RM’000 RM’000 RM’000 RM’000

Term financing

- Home financing 8,691,993 273,525 256,585 107,181 9,329,284

- Syndicated financing 546,137 - - - 546,137

- Hire purchase receivables 1,523,090 6,555 11,477 1,969 1,543,091

- Other term financing 12,174,092 146,614 164,357 125,271 12,610,334

Other financing 4,495,049 4,757 9,704 31,808 4,541,318

27,430,361 431,451 442,123 266,229 28,570,164

Less:

-Stage 1 - 12 Months ECL (119,065) (1,173) - - (120,238)

-Stage 2 - Lifetime ECL

not credit impaired - (12,545) (10,713) - (23,258)

-Stage 3 - Lifetime ECL

credit impaired - - - (79,024) (79,024)

Total net financing 27,311,296 417,733 431,410 187,205 28,347,644

399