Page 399 - Bank-Muamalat_Annual-Report-2023

P. 399

ANNUAL REPORT 2023

OUR NUMBERS

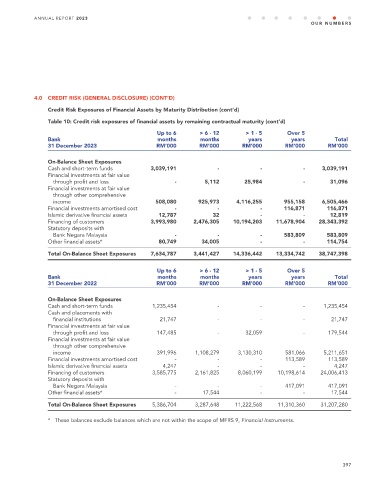

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Risk Exposures of Financial Assets by Maturity Distribution (cont’d)

Table 10: Credit risk exposures of financial assets by remaining contractual maturity (cont’d)

Up to 6 > 6 - 12 > 1 - 5 Over 5

Bank months months years years Total

31 December 2023 RM’000 RM’000 RM’000 RM’000 RM’000

On-Balance Sheet Exposures

Cash and short-term funds 3,039,191 - - - 3,039,191

Financial investments at fair value

through profit and loss - 5,112 25,984 - 31,096

Financial investments at fair value

through other comprehensive

income 508,080 925,973 4,116,255 955,158 6,505,466

Financial investments amortised cost - - - 116,871 116,871

Islamic derivative financial assets 12,787 32 - - 12,819

Financing of customers 3,993,980 2,476,305 10,194,203 11,678,904 28,343,392

Statutory deposits with

Bank Negara Malaysia - - - 583,809 583,809

Other financial assets* 80,749 34,005 - - 114,754

Total On-Balance Sheet Exposures 7,634,787 3,441,427 14,336,442 13,334,742 38,747,398

Up to 6 > 6 - 12 > 1 - 5 Over 5

Bank months months years years Total

31 December 2022 RM’000 RM’000 RM’000 RM’000 RM’000

On-Balance Sheet Exposures

Cash and short-term funds 1,235,454 - - - 1,235,454

Cash and placements with

financial institutions 21,747 - - - 21,747

Financial investments at fair value

through profit and loss 147,485 - 32,059 - 179,544

Financial investments at fair value

through other comprehensive

income 391,996 1,108,279 3,130,310 581,066 5,211,651

Financial investments amortised cost - - - 113,589 113,589

Islamic derivative financial assets 4,247 - - - 4,247

Financing of customers 3,585,775 2,161,825 8,060,199 10,198,614 24,006,413

Statutory deposits with

Bank Negara Malaysia - - - 417,091 417,091

Other financial assets* - 17,544 - - 17,544

Total On-Balance Sheet Exposures 5,386,704 3,287,648 11,222,568 11,310,360 31,207,280

* These balances exclude balances which are not within the scope of MFRS 9, Financial Instruments.

397