Page 404 - Bank-Muamalat_Annual-Report-2023

P. 404

BANK MUAMALAT MALAYSIA BERHAD

BASEL II

PILLAR 3 DISCLOSURE

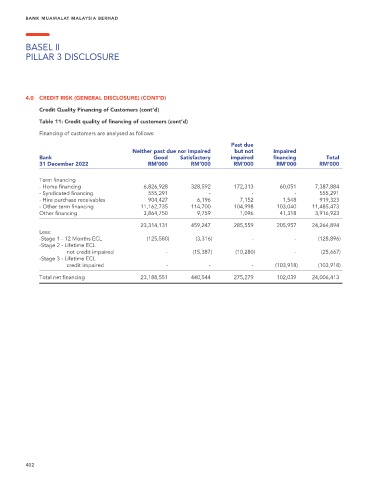

4.0 CREDIT RISK (GENERAL DISCLOSURE) (CONT’D)

Credit Quality Financing of Customers (cont’d)

Table 11: Credit quality of financing of customers (cont’d)

Financing of customers are analysed as follows:

Past due

Neither past due nor impaired but not Impaired

Bank Good Satisfactory impaired financing Total

31 December 2022 RM’000 RM’000 RM’000 RM’000 RM’000

Term financing

- Home financing 6,826,928 328,592 172,313 60,051 7,387,884

- Syndicated financing 555,291 - - - 555,291

- Hire purchase receivables 904,427 6,196 7,152 1,548 919,323

- Other term financing 11,162,735 114,700 104,998 103,040 11,485,473

Other financing 3,864,750 9,759 1,096 41,318 3,916,923

23,314,131 459,247 285,559 205,957 24,264,894

Less:

-Stage 1 - 12 Months ECL (125,580) (3,316) - - (128,896)

-Stage 2 - Lifetime ECL

not credit impaired - (15,387) (10,280) - (25,667)

-Stage 3 - Lifetime ECL

credit impaired - - - (103,918) (103,918)

Total net financing 23,188,551 440,544 275,279 102,039 24,006,413

402