Page 280 - Bank-Muamalat_Annual-Report-2023

P. 280

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

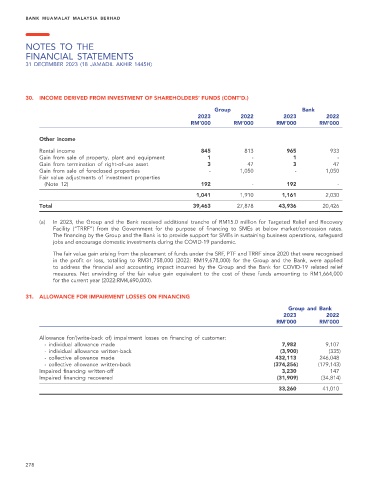

30. INCOME DERIVED FROM INVESTMENT OF SHAREHOLDERS’ FUNDS (CONT’D.)

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Other income

Rental income 845 813 965 933

Gain from sale of property, plant and equipment 1 - 1 -

Gain from termination of right-of-use asset 3 47 3 47

Gain from sale of foreclosed properties - 1,050 - 1,050

Fair value adjustments of investment properties

(Note 12) 192 - 192 -

1,041 1,910 1,161 2,030

Total 39,463 27,878 43,936 20,426

(a) In 2023, the Group and the Bank received additional tranche of RM15.0 million for Targeted Relief and Recovery

Facility (“TRRF”) from the Government for the purpose of financing to SMEs at below market/concession rates.

The financing by the Group and the Bank is to provide support for SMEs in sustaining business operations, safeguard

jobs and encourage domestic investments during the COVID-19 pandemic.

The fair value gain arising from the placement of funds under the SRF, PTF and TRRF since 2020 that were recognised

in the profit or loss, totalling to RM31,758,000 (2022: RM19,678,000) for the Group and the Bank, were applied

to address the financial and accounting impact incurred by the Group and the Bank for COVID-19 related relief

measures. Net unwinding of the fair value gain equivalent to the cost of these funds amounting to RM1,664,000

for the current year (2022:RM4,690,000).

31. ALLOWANCE FOR IMPAIRMENT LOSSES ON FINANCING

Group and Bank

2023 2022

RM’000 RM’000

Allowance for/(write-back of) impairment losses on financing of customer:

- individual allowance made 7,982 9,107

- individual allowance written-back (3,900) (335)

- collective allowance made 432,113 246,048

- collective allowance written-back (374,256) (179,143)

Impaired financing written-off 3,230 147

Impaired financing recovered (31,909) (34,814)

33,260 41,010

278