Page 275 - Bank-Muamalat_Annual-Report-2023

P. 275

ANNUAL REPORT 2023

OUR NUMBERS

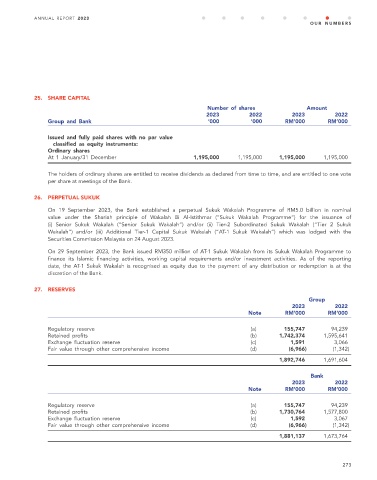

25. SHARE CAPITAL

Number of shares Amount

2023 2022 2023 2022

Group and Bank ‘000 ‘000 RM’000 RM’000

Issued and fully paid shares with no par value

classified as equity instruments:

Ordinary shares

At 1 January/31 December 1,195,000 1,195,000 1,195,000 1,195,000

The holders of ordinary shares are entitled to receive dividends as declared from time to time, and are entitled to one vote

per share at meetings of the Bank.

26. PERPETUAL SUKUK

On 19 September 2023, the Bank established a perpetual Sukuk Wakalah Programme of RM5.0 billion in nominal

value under the Shariah principle of Wakalah Bi Al-Istithmar (“Sukuk Wakalah Programme“) for the issuance of

(i) Senior Sukuk Wakalah (“Senior Sukuk Wakalah”) and/or (ii) Tier-2 Subordinated Sukuk Wakalah (“Tier 2 Sukuk

Wakalah”) and/or (iii) Additional Tier-1 Capital Sukuk Wakalah (“AT-1 Sukuk Wakalah”) which was lodged with the

Securities Commission Malaysia on 24 August 2023.

On 29 September 2023, the Bank issued RM350 million of AT-1 Sukuk Wakalah from its Sukuk Wakalah Programme to

finance its Islamic financing activities, working capital requirements and/or investment activities. As of the reporting

date, the AT-1 Sukuk Wakalah is recognised as equity due to the payment of any distribution or redemption is at the

discretion of the Bank.

27. RESERVES

Group

2023 2022

Note RM’000 RM’000

Regulatory reserve (a) 155,747 94,239

Retained profits (b) 1,742,374 1,595,641

Exchange fluctuation reserve (c) 1,591 3,066

Fair value through other comprehensive income (d) (6,966) (1,342)

1,892,746 1,691,604

Bank

2023 2022

Note RM’000 RM’000

Regulatory reserve (a) 155,747 94,239

Retained profits (b) 1,730,764 1,577,800

Exchange fluctuation reserve (c) 1,592 3,067

Fair value through other comprehensive income (d) (6,966) (1,342)

1,881,137 1,673,764

273