Page 276 - Bank-Muamalat_Annual-Report-2023

P. 276

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

27. RESERVES (CONT’D.)

(a) Regulatory reserve

Regulatory reserve is maintained in aggregate, loss allowance for non-credit impaired exposures (commonly

known as Stage 1 and Stage 2 provisions) that has been assessed and recognised in accordance with MFRS and

which has been transferred from the retained profits, of no less than 1% of total exposures, in accordance with

BNM’s Revised Financial Reporting for Islamic Banking Institutions Policy Document issued on 29 April 2022.

(b) Retained profits

The Bank may distribute dividends out of its entire retained profits as at 31 December 2023 under the single tier system.

(c) Exchange fluctuation reserve

The exchange fluctuation reserve represents exchange differences arising from the translation of the financial

statements of the Labuan Offshore Branch whose functional currencies are different from that of the Group’s presentation

currency.

(d) Fair value through other comprehensive income

This represent the cumulative fair value changes, net of tax, of fair value through other comprehensive income

financial assets until they are disposed of or impaired.

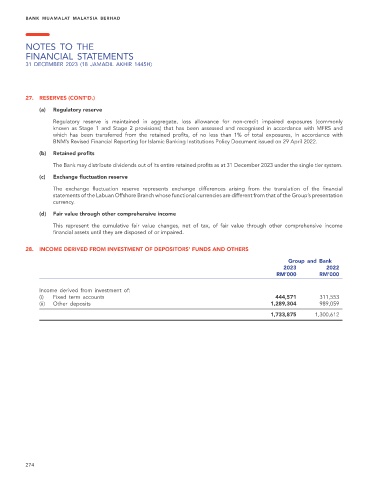

28. INCOME DERIVED FROM INVESTMENT OF DEPOSITORS’ FUNDS AND OTHERS

Group and Bank

2023 2022

RM’000 RM’000

Income derived from investment of:

(i) Fixed term accounts 444,571 311,553

(ii) Other deposits 1,289,304 989,059

1,733,875 1,300,612

274