Page 277 - Bank-Muamalat_Annual-Report-2023

P. 277

ANNUAL REPORT 2023

OUR NUMBERS

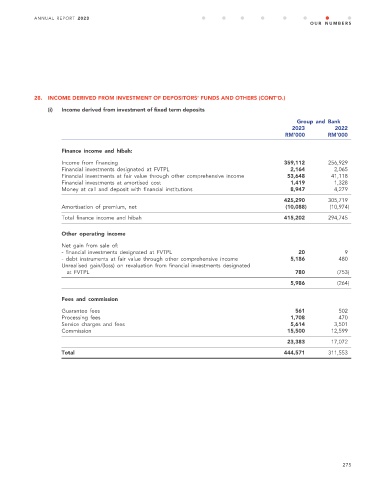

28. INCOME DERIVED FROM INVESTMENT OF DEPOSITORS’ FUNDS AND OTHERS (CONT’D.)

(i) Income derived from investment of fixed term deposits

Group and Bank

2023 2022

RM’000 RM’000

Finance income and hibah:

Income from financing 359,112 256,929

Financial investments designated at FVTPL 2,164 2,065

Financial investments at fair value through other comprehensive income 53,648 41,118

Financial investments at amortised cost 1,419 1,328

Money at call and deposit with financial institutions 8,947 4,279

425,290 305,719

Amortisation of premium, net (10,088) (10,974)

Total finance income and hibah 415,202 294,745

Other operating income

Net gain from sale of:

- financial investments designated at FVTPL 20 9

- debt instruments at fair value through other comprehensive income 5,186 480

Unrealised gain/(loss) on revaluation from financial investments designated

at FVTPL 780 (753)

5,986 (264)

Fees and commission

Guarantee fees 561 502

Processing fees 1,708 470

Service charges and fees 5,614 3,501

Commission 15,500 12,599

23,383 17,072

Total 444,571 311,553

275