Page 278 - Bank-Muamalat_Annual-Report-2023

P. 278

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

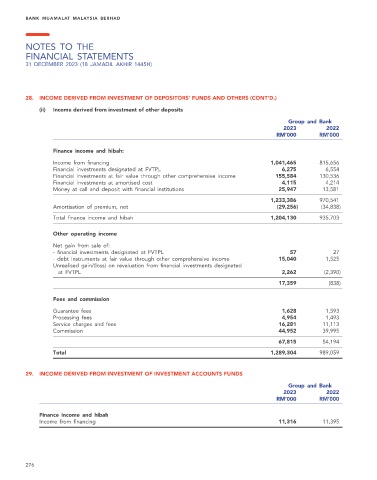

28. INCOME DERIVED FROM INVESTMENT OF DEPOSITORS’ FUNDS AND OTHERS (CONT’D.)

(ii) Income derived from investment of other deposits

Group and Bank

2023 2022

RM’000 RM’000

Finance income and hibah:

Income from financing 1,041,465 815,656

Financial investments designated at FVTPL 6,275 6,554

Financial investments at fair value through other comprehensive income 155,584 130,536

Financial investments at amortised cost 4,115 4,214

Money at call and deposit with financial institutions 25,947 13,581

1,233,386 970,541

Amortisation of premium, net (29,256) (34,838)

Total finance income and hibah 1,204,130 935,703

Other operating income

Net gain from sale of:

- financial investments designated at FVTPL 57 27

- debt instruments at fair value through other comprehensive income 15,040 1,525

Unrealised gain/(loss) on revaluation from financial investments designated

at FVTPL 2,262 (2,390)

17,359 (838)

Fees and commission

Guarantee fees 1,628 1,593

Processing fees 4,954 1,493

Service charges and fees 16,281 11,113

Commission 44,952 39,995

67,815 54,194

Total 1,289,304 989,059

29. INCOME DERIVED FROM INVESTMENT OF INVESTMENT ACCOUNTS FUNDS

Group and Bank

2023 2022

RM’000 RM’000

Finance income and hibah

Income from financing 11,316 11,395

276