Page 279 - Bank-Muamalat_Annual-Report-2023

P. 279

ANNUAL REPORT 2023

OUR NUMBERS

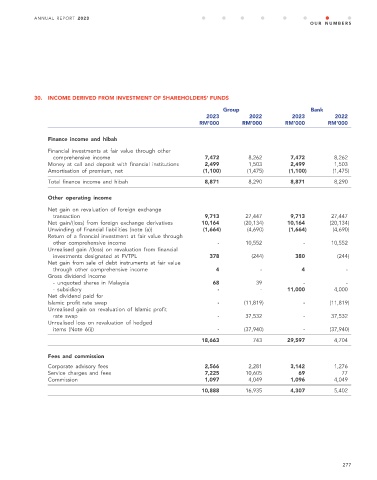

30. INCOME DERIVED FROM INVESTMENT OF SHAREHOLDERS’ FUNDS

Group Bank

2023 2022 2023 2022

RM’000 RM’000 RM’000 RM’000

Finance income and hibah

Financial investments at fair value through other

comprehensive income 7,472 8,262 7,472 8,262

Money at call and deposit with financial institutions 2,499 1,503 2,499 1,503

Amortisation of premium, net (1,100) (1,475) (1,100) (1,475)

Total finance income and hibah 8,871 8,290 8,871 8,290

Other operating income

Net gain on revaluation of foreign exchange

transaction 9,713 27,447 9,713 27,447

Net gain/(loss) from foreign exchange derivatives 10,164 (20,134) 10,164 (20,134)

Unwinding of financial liabilities (note (a)) (1,664) (4,690) (1,664) (4,690)

Return of a financial investment at fair value through

other comprehensive income - 10,552 - 10,552

Unrealised gain /(loss) on revaluation from financial

investments designated at FVTPL 378 (244) 380 (244)

Net gain from sale of debt instruments at fair value

through other comprehensive income 4 - 4 -

Gross dividend income

- unquoted shares in Malaysia 68 39 - -

- subsidiary - - 11,000 4,000

Net dividend paid for

Islamic profit rate swap - (11,819) - (11,819)

Unrealised gain on revaluation of Islamic profit

rate swap - 37,532 - 37,532

Unrealised loss on revaluation of hedged

items (Note 6(i)) - (37,940) - (37,940)

18,663 743 29,597 4,704

Fees and commission

Corporate advisory fees 2,566 2,281 3,142 1,276

Service charges and fees 7,225 10,605 69 77

Commission 1,097 4,049 1,096 4,049

10,888 16,935 4,307 5,402

277