Page 203 - Bank-Muamalat_Annual-Report-2023

P. 203

ANNUAL REPORT 2023

OUR NUMBERS

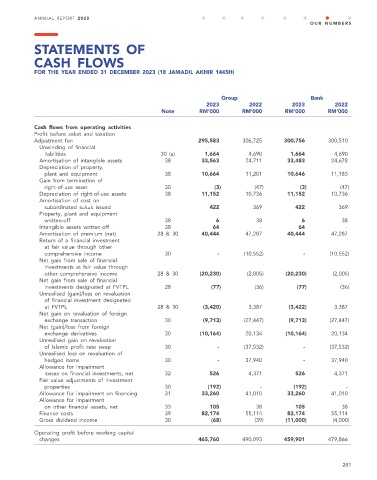

STATEMENTS OF

CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

Group Bank

2023 2022 2023 2022

Note RM’000 RM’000 RM’000 RM’000

Cash flows from operating activities

Profit before zakat and taxation

Adjustment for: 295,583 306,725 300,756 300,510

Unwinding of financial

liabilities 30 (a) 1,664 4,690 1,664 4,690

Amortisation of intangible assets 38 33,563 24,711 33,483 24,678

Depreciation of property,

plant and equipment 38 10,664 11,201 10,646 11,183

Gain from termination of

right-of-use asset 30 (3) (47) (3) (47)

Depreciation of right-of-use assets 38 11,152 10,736 11,152 10,736

Amortisation of cost on

subordinated sukuk issued 422 369 422 369

Property, plant and equipment

written-off 38 6 38 6 38

Intangible assets written-off 38 64 - 64 -

Amortisation of premium (net) 28 & 30 40,444 47,287 40,444 47,287

Return of a financial investment

at fair value through other

comprehensive income 30 - (10,552) - (10,552)

Net gain from sale of financial

investments at fair value through

other comprehensive income 28 & 30 (20,230) (2,005) (20,230) (2,005)

Net gain from sale of financial

investments designated at FVTPL 28 (77) (36) (77) (36)

Unrealised (gain)/loss on revaluation

of financial investment designated

at FVTPL 28 & 30 (3,420) 3,387 (3,422) 3,387

Net gain on revaluation of foreign

exchange transaction 30 (9,713) (27,447) (9,713) (27,447)

Net (gain)/loss from foreign

exchange derivatives 30 (10,164) 20,134 (10,164) 20,134

Unrealised gain on revaluation

of Islamic profit rate swap 30 - (37,532) - (37,532)

Unrealised loss on revaluation of

hedged items 30 - 37,940 - 37,940

Allowance for impairment

losses on financial investments, net 32 526 4,371 526 4,371

Fair value adjustments of investment

properties 30 (192) - (192) -

Allowance for impairment on financing 31 33,260 41,010 33,260 41,010

Allowance for impairment

on other financial assets, net 33 105 38 105 38

Finance costs 39 82,174 55,114 82,174 55,114

Gross dividend income 30 (68) (39) (11,000) (4,000)

Operating profit before working capital

changes 465,760 490,093 459,901 479,866

201