Page 206 - Bank-Muamalat_Annual-Report-2023

P. 206

BANK MUAMALAT MALAYSIA BERHAD

STATEMENTS OF

CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H) (cont’d.)

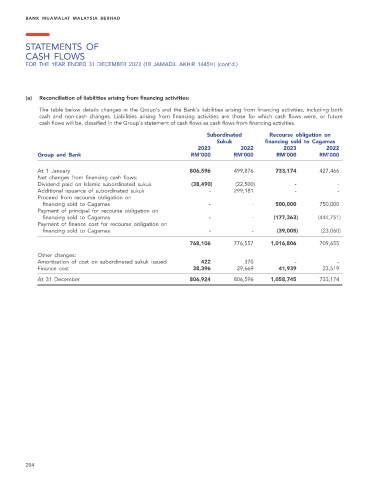

(a) Reconciliation of liabilities arising from financing activities:

The table below details changes in the Group’s and the Bank’s liabilities arising from financing activities, including both

cash and non-cash changes. Liabilities arising from financing activities are those for which cash flows were, or future

cash flows will be, classified in the Group’s statement of cash flows as cash flows from financing activities.

Subordinated Recourse obligation on

Sukuk financing sold to Cagamas

2023 2022 2023 2022

Group and Bank RM’000 RM’000 RM’000 RM’000

At 1 January 806,596 499,876 733,174 427,466

Net changes from financing cash flows:

Dividend paid on Islamic subordinated sukuk (38,490) (22,500) - -

Additional issuance of subordinated sukuk - 299,181 - -

Proceed from recourse obligation on

financing sold to Cagamas - - 500,000 750,000

Payment of principal for recourse obligation on

financing sold to Cagamas - - (177,363) (444,751)

Payment of finance cost for recourse obligation on

financing sold to Cagamas - - (39,005) (23,060)

768,106 776,557 1,016,806 709,655

Other changes:

Amortisation of cost on subordinated sukuk issued 422 370 - -

Finance cost 38,396 29,669 41,939 23,519

At 31 December 806,924 806,596 1,058,745 733,174

204