Page 209 - Bank-Muamalat_Annual-Report-2023

P. 209

ANNUAL REPORT 2023

OUR NUMBERS

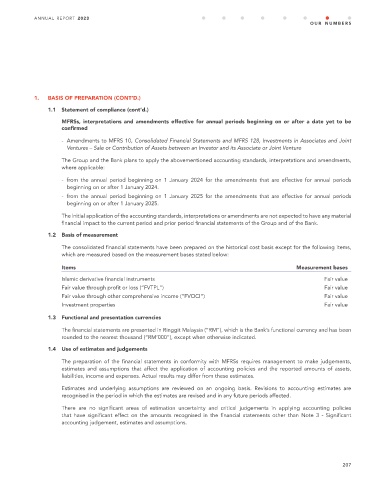

1. BASIS OF PREPARATION (CONT’D.)

1.1 Statement of compliance (cont’d.)

MFRSs, interpretations and amendments effective for annual periods beginning on or after a date yet to be

confirmed

- Amendments to MFRS 10, Consolidated Financial Statements and MFRS 128, Investments in Associates and Joint

Ventures – Sale or Contribution of Assets between an Investor and its Associate or Joint Venture

The Group and the Bank plans to apply the abovementioned accounting standards, interpretations and amendments,

where applicable:

- from the annual period beginning on 1 January 2024 for the amendments that are effective for annual periods

beginning on or after 1 January 2024.

- from the annual period beginning on 1 January 2025 for the amendments that are effective for annual periods

beginning on or after 1 January 2025.

The initial application of the accounting standards, interpretations or amendments are not expected to have any material

financial impact to the current period and prior period financial statements of the Group and of the Bank.

1.2 Basis of measurement

The consolidated financial statements have been prepared on the historical cost basis except for the following items,

which are measured based on the measurement bases stated below:

Items Measurement bases

Islamic derivative financial instruments Fair value

Fair value through profit or loss (“FVTPL”) Fair value

Fair value through other comprehensive income (“FVOCI”) Fair value

Investment properties Fair value

1.3 Functional and presentation currencies

The financial statements are presented in Ringgit Malaysia (“RM”), which is the Bank’s functional currency and has been

rounded to the nearest thousand (“RM’000”), except when otherwise indicated.

1.4 Use of estimates and judgements

The preparation of the financial statements in conformity with MFRSs requires management to make judgements,

estimates and assumptions that affect the application of accounting policies and the reported amounts of assets,

liabilities, income and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are

recognised in the period in which the estimates are revised and in any future periods affected.

There are no significant areas of estimation uncertainty and critical judgements in applying accounting policies

that have significant effect on the amounts recognised in the financial statements other than Note 3 - Significant

accounting judgement, estimates and assumptions.

207