Page 75 - Bank-Muamalat-Annual-Report-2021

P. 75

ANNUAL REPORT 2021 73

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

The Correspondent Banking Unit (CB) represents an essential TCM expects the HQLA portfolio to be pressured in FY2022

component for the global payment system, specifically in line with rising yields and higher sovereign bonds supply

to facilitate clients for international payment and trade as the budget remains expansionary with spending projected

transactions. CB has constantly engaged with global to increase. Regardless, demand for local assets will remain

counterparties as a subsequence of the enhanced global supported from a well-diversified base of investment

KYC monitoring process, and to ensure fulfilment of the institutions, interbank and foreign participants. As such,

Service Level Agreement. portfolios will continue to be managed by maintaining

minimum HQLA and short durations. Apart from that, an

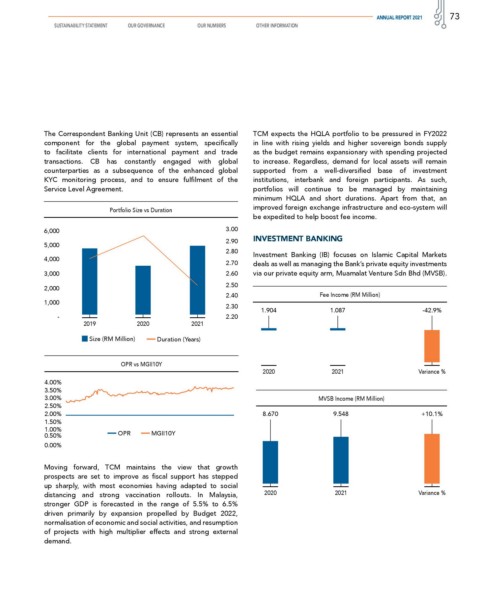

Portfolio Size vs Duration improved foreign exchange infrastructure and eco-system will

be expedited to help boost fee income.

6,000 3.00

INVESTMENT BANKING

2.90

5,000

2.80

4,000 Investment Banking (IB) focuses on Islamic Capital Markets

2.70 deals as well as managing the Bank’s private equity investments

3,000 2.60 via our private equity arm, Muamalat Venture Sdn Bhd (MVSB).

2.50

2,000

2.40 Fee Income (RM Million)

1,000

2.30

1.904 1.087 -42.9%

- 2.20

2019 2020 2021

Size (RM Million) Duration (Years)

OPR vs MGII10Y

2020 2021 Variance %

4.00%

3.50%

3.00% MVSB Income (RM Million)

2.50%

2.00% 8.670 9.548 +10.1%

1.50%

1.00%

0.50% OPR MGII10Y

0.00%

Moving forward, TCM maintains the view that growth

prospects are set to improve as fiscal support has stepped

up sharply, with most economies having adapted to social

distancing and strong vaccination rollouts. In Malaysia, 2020 2021 Variance %

stronger GDP is forecasted in the range of 5.5% to 6.5%

driven primarily by expansion propelled by Budget 2022,

normalisation of economic and social activities, and resumption

of projects with high multiplier effects and strong external

demand.