Page 78 - Bank-Muamalat-Annual-Report-2021

P. 78

76 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

SUBSIDIARIES

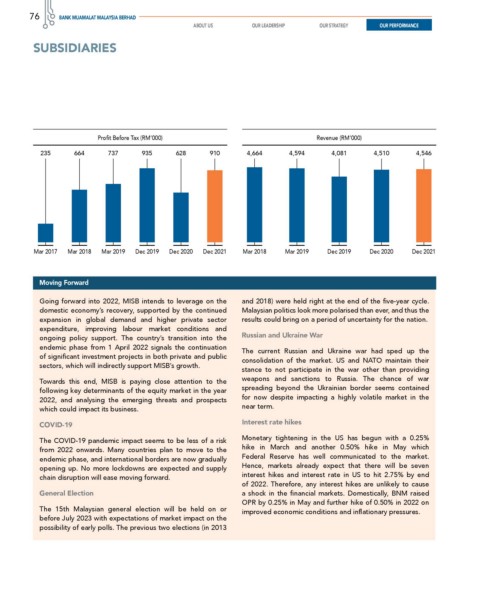

Profit Before Tax (RM’000) Revenue (RM’000)

235 664 737 935 628 910 4,664 4,594 4,081 4,510 4,546

Mar 2017 Mar 2018 Mar 2019 Dec 2019 Dec 2020 Dec 2021 Mar 2018 Mar 2019 Dec 2019 Dec 2020 Dec 2021

Moving Forward

Going forward into 2022, MISB intends to leverage on the and 2018) were held right at the end of the five-year cycle.

domestic economy’s recovery, supported by the continued Malaysian politics look more polarised than ever, and thus the

expansion in global demand and higher private sector results could bring on a period of uncertainty for the nation.

expenditure, improving labour market conditions and

ongoing policy support. The country’s transition into the Russian and Ukraine War

endemic phase from 1 April 2022 signals the continuation

The current Russian and Ukraine war had sped up the

of significant investment projects in both private and public

consolidation of the market. US and NATO maintain their

sectors, which will indirectly support MISB’s growth.

stance to not participate in the war other than providing

weapons and sanctions to Russia. The chance of war

Towards this end, MISB is paying close attention to the

spreading beyond the Ukrainian border seems contained

following key determinants of the equity market in the year

for now despite impacting a highly volatile market in the

2022, and analysing the emerging threats and prospects

near term.

which could impact its business.

COVID-19 Interest rate hikes

Monetary tightening in the US has begun with a 0.25%

The COVID-19 pandemic impact seems to be less of a risk

hike in March and another 0.50% hike in May which

from 2022 onwards. Many countries plan to move to the

Federal Reserve has well communicated to the market.

endemic phase, and international borders are now gradually

Hence, markets already expect that there will be seven

opening up. No more lockdowns are expected and supply

interest hikes and interest rate in US to hit 2.75% by end

chain disruption will ease moving forward.

of 2022. Therefore, any interest hikes are unlikely to cause

General Election a shock in the financial markets. Domestically, BNM raised

OPR by 0.25% in May and further hike of 0.50% in 2022 on

The 15th Malaysian general election will be held on or improved economic conditions and inflationary pressures.

before July 2023 with expectations of market impact on the

possibility of early polls. The previous two elections (in 2013