Page 330 - Bank-Muamalat-Annual-Report-2021

P. 330

328 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

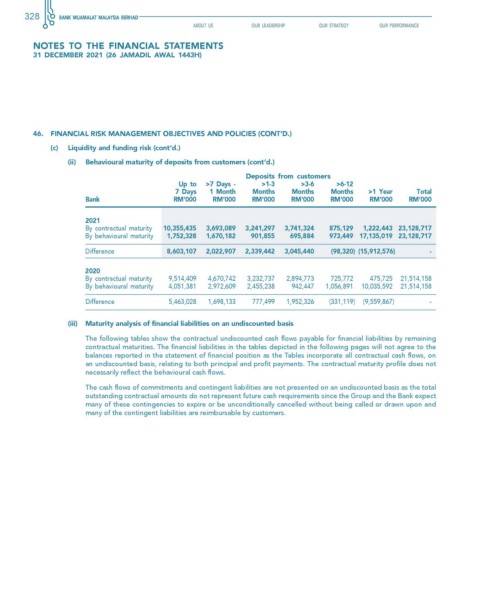

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(c) Liquidity and funding risk (cont’d.)

(ii) Behavioural maturity of deposits from customers (cont’d.)

Deposits from customers

up to >7 Days - >1-3 >3-6 >6-12

7 Days 1 Month Months Months Months >1 year Total

Bank RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2021

By contractual maturity 10,355,435 3,693,089 3,241,297 3,741,324 875,129 1,222,443 23,128,717

By behavioural maturity 1,752,328 1,670,182 901,855 695,884 973,449 17,135,019 23,128,717

Difference 8,603,107 2,022,907 2,339,442 3,045,440 (98,320) (15,912,576) -

2020

By contractual maturity 9,514,409 4,670,742 3,232,737 2,894,773 725,772 475,725 21,514,158

By behavioural maturity 4,051,381 2,972,609 2,455,238 942,447 1,056,891 10,035,592 21,514,158

Difference 5,463,028 1,698,133 777,499 1,952,326 (331,119) (9,559,867) -

(iii) Maturity analysis of financial liabilities on an undiscounted basis

The following tables show the contractual undiscounted cash flows payable for financial liabilities by remaining

contractual maturities. The financial liabilities in the tables depicted in the following pages will not agree to the

balances reported in the statement of financial position as the Tables incorporate all contractual cash flows, on

an undiscounted basis, relating to both principal and profit payments. The contractual maturity profile does not

necessarily reflect the behavioural cash flows.

The cash flows of commitments and contingent liabilities are not presented on an undiscounted basis as the total

outstanding contractual amounts do not represent future cash requirements since the Group and the Bank expect

many of these contingencies to expire or be unconditionally cancelled without being called or drawn upon and

many of the contingent liabilities are reimbursable by customers.