Page 329 - Bank-Muamalat-Annual-Report-2021

P. 329

ANNUAL REPORT 2021 327

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

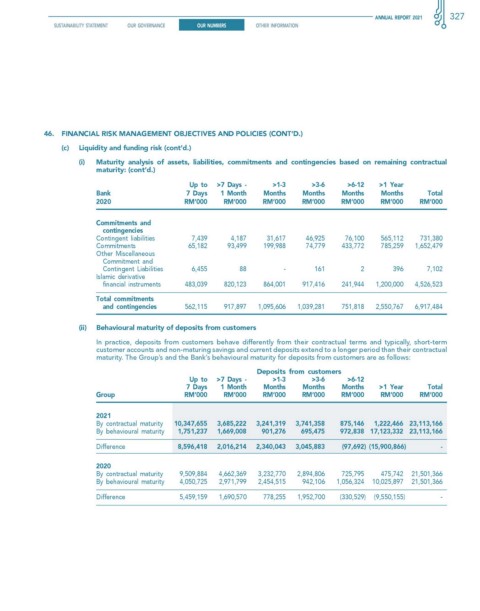

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(c) Liquidity and funding risk (cont’d.)

(i) Maturity analysis of assets, liabilities, commitments and contingencies based on remaining contractual

maturity: (cont’d.)

up to >7 Days - >1-3 >3-6 >6-12 >1 year

Bank 7 Days 1 Month Months Months Months Months Total

2020 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

commitments and

contingencies

Contingent liabilities 7,439 4,187 31,617 46,925 76,100 565,112 731,380

Commitments 65,182 93,499 199,988 74,779 433,772 785,259 1,652,479

Other Miscellaneous

Commitment and

Contingent Liabilities 6,455 88 - 161 2 396 7,102

Islamic derivative

financial instruments 483,039 820,123 864,001 917,416 241,944 1,200,000 4,526,523

Total commitments

and contingencies 562,115 917,897 1,095,606 1,039,281 751,818 2,550,767 6,917,484

(ii) Behavioural maturity of deposits from customers

In practice, deposits from customers behave differently from their contractual terms and typically, short-term

customer accounts and non-maturing savings and current deposits extend to a longer period than their contractual

maturity. The Group’s and the Bank’s behavioural maturity for deposits from customers are as follows:

Deposits from customers

up to >7 Days - >1-3 >3-6 >6-12

7 Days 1 Month Months Months Months >1 year Total

Group RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

2021

By contractual maturity 10,347,655 3,685,222 3,241,319 3,741,358 875,146 1,222,466 23,113,166

By behavioural maturity 1,751,237 1,669,008 901,276 695,475 972,838 17,123,332 23,113,166

Difference 8,596,418 2,016,214 2,340,043 3,045,883 (97,692) (15,900,866) -

2020

By contractual maturity 9,509,884 4,662,369 3,232,770 2,894,806 725,795 475,742 21,501,366

By behavioural maturity 4,050,725 2,971,799 2,454,515 942,106 1,056,324 10,025,897 21,501,366

Difference 5,459,159 1,690,570 778,255 1,952,700 (330,529) (9,550,155) -