Page 328 - Bank-Muamalat-Annual-Report-2021

P. 328

326 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

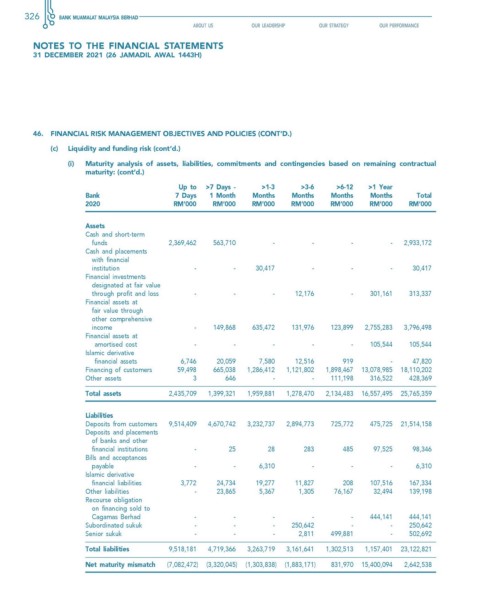

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(c) Liquidity and funding risk (cont’d.)

(i) Maturity analysis of assets, liabilities, commitments and contingencies based on remaining contractual

maturity: (cont’d.)

up to >7 Days - >1-3 >3-6 >6-12 >1 year

Bank 7 Days 1 Month Months Months Months Months Total

2020 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000 RM’000

assets

Cash and short-term

funds 2,369,462 563,710 - - - - 2,933,172

Cash and placements

with financial

institution - - 30,417 - - - 30,417

Financial investments

designated at fair value

through profit and loss - - - 12,176 - 301,161 313,337

Financial assets at

fair value through

other comprehensive

income - 149,868 635,472 131,976 123,899 2,755,283 3,796,498

Financial assets at

amortised cost - - - - - 105,544 105,544

Islamic derivative

financial assets 6,746 20,059 7,580 12,516 919 - 47,820

Financing of customers 59,498 665,038 1,286,412 1,121,802 1,898,467 13,078,985 18,110,202

Other assets 3 646 - - 111,198 316,522 428,369

total assets 2,435,709 1,399,321 1,959,881 1,278,470 2,134,483 16,557,495 25,765,359

Liabilities

Deposits from customers 9,514,409 4,670,742 3,232,737 2,894,773 725,772 475,725 21,514,158

Deposits and placements

of banks and other

financial institutions - 25 28 283 485 97,525 98,346

Bills and acceptances

payable - - 6,310 - - - 6,310

Islamic derivative

financial liabilities 3,772 24,734 19,277 11,827 208 107,516 167,334

Other liabilities - 23,865 5,367 1,305 76,167 32,494 139,198

Recourse obligation

on financing sold to

Cagamas Berhad - - - - - 444,141 444,141

Subordinated sukuk - - - 250,642 - - 250,642

Senior sukuk - - - 2,811 499,881 - 502,692

Total liabilities 9,518,181 4,719,366 3,263,719 3,161,641 1,302,513 1,157,401 23,122,821

Net maturity mismatch (7,082,472) (3,320,045) (1,303,838) (1,883,171) 831,970 15,400,094 2,642,538