Page 335 - Bank-Muamalat-Annual-Report-2021

P. 335

ANNUAL REPORT 2021 333

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

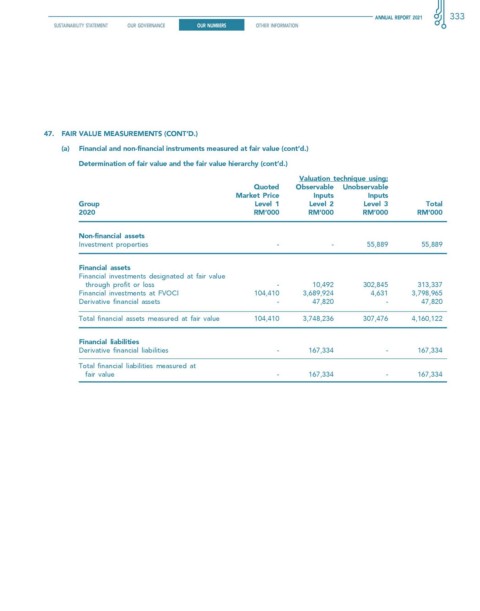

47. fAIR vALue MeAsuReMeNTs (cONT’D.)

(a) financial and non-financial instruments measured at fair value (cont’d.)

Determination of fair value and the fair value hierarchy (cont’d.)

valuation technique using;

Quoted Observable unobservable

Market Price Inputs Inputs

Group Level 1 Level 2 Level 3 Total

2020 RM’000 RM’000 RM’000 RM’000

Non-financial assets

Investment properties - - 55,889 55,889

financial assets

Financial investments designated at fair value

through profit or loss - 10,492 302,845 313,337

Financial investments at FVOCI 104,410 3,689,924 4,631 3,798,965

Derivative financial assets - 47,820 - 47,820

Total financial assets measured at fair value 104,410 3,748,236 307,476 4,160,122

financial liabilities

Derivative financial liabilities - 167,334 - 167,334

Total financial liabilities measured at

fair value - 167,334 - 167,334