Page 337 - Bank-Muamalat-Annual-Report-2021

P. 337

ANNUAL REPORT 2021 335

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

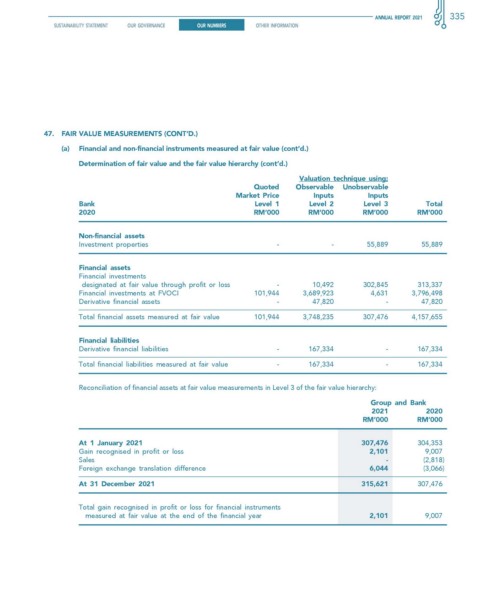

47. fAIR vALue MeAsuReMeNTs (cONT’D.)

(a) financial and non-financial instruments measured at fair value (cont’d.)

Determination of fair value and the fair value hierarchy (cont’d.)

valuation technique using;

Quoted Observable unobservable

Market Price Inputs Inputs

Bank Level 1 Level 2 Level 3 Total

2020 RM’000 RM’000 RM’000 RM’000

Non-financial assets

Investment properties - - 55,889 55,889

financial assets

Financial investments

designated at fair value through profit or loss - 10,492 302,845 313,337

Financial investments at FVOCI 101,944 3,689,923 4,631 3,796,498

Derivative financial assets - 47,820 - 47,820

Total financial assets measured at fair value 101,944 3,748,235 307,476 4,157,655

financial liabilities

Derivative financial liabilities - 167,334 - 167,334

Total financial liabilities measured at fair value - 167,334 - 167,334

Reconciliation of financial assets at fair value measurements in Level 3 of the fair value hierarchy:

Group and Bank

2021 2020

rM’000 rM’000

At 1 January 2021 307,476 304,353

Gain recognised in profit or loss 2,101 9,007

Sales - (2,818)

Foreign exchange translation difference 6,044 (3,066)

At 31 December 2021 315,621 307,476

Total gain recognised in profit or loss for financial instruments

measured at fair value at the end of the financial year 2,101 9,007