Page 342 - Bank-Muamalat-Annual-Report-2021

P. 342

340 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

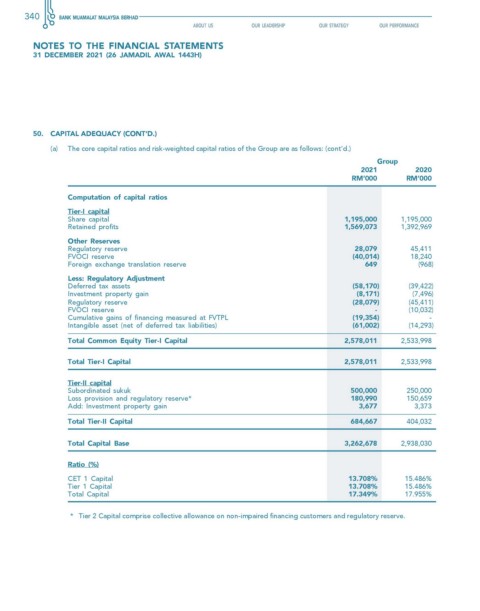

50. cAPITAL ADeQuAcy (cONT’D.)

(a) The core capital ratios and risk-weighted capital ratios of the Group are as follows: (cont’d.)

Group

2021 2020

rM’000 rM’000

computation of capital ratios

Tier-I capital

Share capital 1,195,000 1,195,000

Retained profits 1,569,073 1,392,969

Other Reserves

Regulatory reserve 28,079 45,411

FVOCI reserve (40,014) 18,240

Foreign exchange translation reserve 649 (968)

Less: Regulatory Adjustment

Deferred tax assets (58,170) (39,422)

Investment property gain (8,171) (7,496)

Regulatory reserve (28,079) (45,411)

FVOCI reserve - (10,032)

Cumulative gains of financing measured at FVTPL (19,354) -

Intangible asset (net of deferred tax liabilities) (61,002) (14,293)

Total common equity Tier-I capital 2,578,011 2,533,998

Total Tier-I capital 2,578,011 2,533,998

Tier-II capital

Subordinated sukuk 500,000 250,000

Loss provision and regulatory reserve* 180,990 150,659

Add: Investment property gain 3,677 3,373

Total Tier-II capital 684,667 404,032

Total capital Base 3,262,678 2,938,030

Ratio (%)

CET 1 Capital 13.708% 15.486%

Tier 1 Capital 13.708% 15.486%

Total Capital 17.349% 17.955%

* Tier 2 Capital comprise collective allowance on non-impaired financing customers and regulatory reserve.