Page 345 - Bank-Muamalat-Annual-Report-2021

P. 345

ANNUAL REPORT 2021 343

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

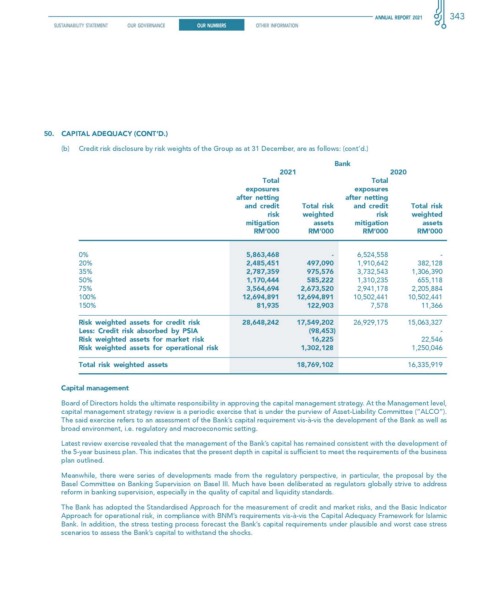

50. cAPITAL ADeQuAcy (cONT’D.)

(b) Credit risk disclosure by risk weights of the Group as at 31 December, are as follows: (cont’d.)

Bank

2021 2020

total total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

rM’000 rM’000 rM’000 rM’000

0% 5,863,468 - 6,524,558 -

20% 2,485,451 497,090 1,910,642 382,128

35% 2,787,359 975,576 3,732,543 1,306,390

50% 1,170,444 585,222 1,310,235 655,118

75% 3,564,694 2,673,520 2,941,178 2,205,884

100% 12,694,891 12,694,891 10,502,441 10,502,441

150% 81,935 122,903 7,578 11,366

Risk weighted assets for credit risk 28,648,242 17,549,202 26,929,175 15,063,327

Less: credit risk absorbed by PsIA (98,453) -

Risk weighted assets for market risk 16,225 22,546

Risk weighted assets for operational risk 1,302,128 1,250,046

Total risk weighted assets 18,769,102 16,335,919

capital management

Board of Directors holds the ultimate responsibility in approving the capital management strategy. At the Management level,

capital management strategy review is a periodic exercise that is under the purview of Asset-Liability Committee (“ALCO”).

The said exercise refers to an assessment of the Bank’s capital requirement vis-à-vis the development of the Bank as well as

broad environment, i.e. regulatory and macroeconomic setting.

Latest review exercise revealed that the management of the Bank’s capital has remained consistent with the development of

the 5-year business plan. This indicates that the present depth in capital is sufficient to meet the requirements of the business

plan outlined.

Meanwhile, there were series of developments made from the regulatory perspective, in particular, the proposal by the

Basel Committee on Banking Supervision on Basel III. Much have been deliberated as regulators globally strive to address

reform in banking supervision, especially in the quality of capital and liquidity standards.

The Bank has adopted the Standardised Approach for the measurement of credit and market risks, and the Basic Indicator

Approach for operational risk, in compliance with BNM’s requirements vis-à-vis the Capital Adequacy Framework for Islamic

Bank. In addition, the stress testing process forecast the Bank’s capital requirements under plausible and worst case stress

scenarios to assess the Bank’s capital to withstand the shocks.