Page 344 - Bank-Muamalat-Annual-Report-2021

P. 344

342 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

50. cAPITAL ADeQuAcy (cONT’D.)

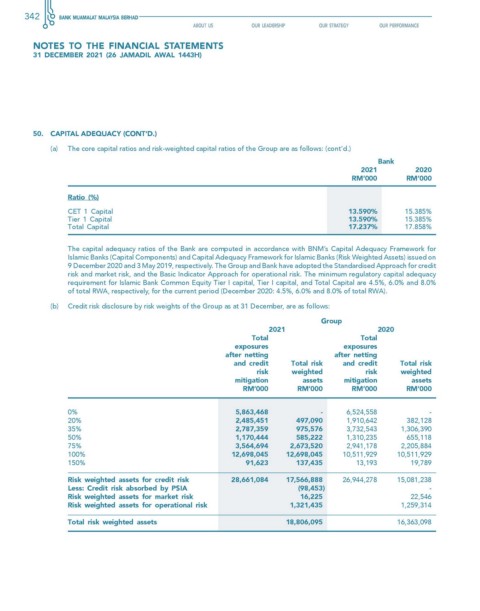

(a) The core capital ratios and risk-weighted capital ratios of the Group are as follows: (cont’d.)

Bank

2021 2020

rM’000 rM’000

Ratio (%)

CET 1 Capital 13.590% 15.385%

Tier 1 Capital 13.590% 15.385%

Total Capital 17.237% 17.858%

The capital adequacy ratios of the Bank are computed in accordance with BNM’s Capital Adequacy Framework for

Islamic Banks (Capital Components) and Capital Adequacy Framework for Islamic Banks (Risk Weighted Assets) issued on

9 December 2020 and 3 May 2019, respectively. The Group and Bank have adopted the Standardised Approach for credit

risk and market risk, and the Basic Indicator Approach for operational risk. The minimum regulatory capital adequacy

requirement for Islamic Bank Common Equity Tier I capital, Tier I capital, and Total Capital are 4.5%, 6.0% and 8.0%

of total RWA, respectively, for the current period (December 2020: 4.5%, 6.0% and 8.0% of total RWA).

(b) Credit risk disclosure by risk weights of the Group as at 31 December, are as follows:

Group

2021 2020

total total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

rM’000 rM’000 rM’000 rM’000

0% 5,863,468 - 6,524,558 -

20% 2,485,451 497,090 1,910,642 382,128

35% 2,787,359 975,576 3,732,543 1,306,390

50% 1,170,444 585,222 1,310,235 655,118

75% 3,564,694 2,673,520 2,941,178 2,205,884

100% 12,698,045 12,698,045 10,511,929 10,511,929

150% 91,623 137,435 13,193 19,789

Risk weighted assets for credit risk 28,661,084 17,566,888 26,944,278 15,081,238

Less: credit risk absorbed by PsIA (98,453) -

Risk weighted assets for market risk 16,225 22,546

Risk weighted assets for operational risk 1,321,435 1,259,314

Total risk weighted assets 18,806,095 16,363,098