Page 21 - Bank-Muamalat-Annual-Report-2021

P. 21

ANNUAL REPORT 2021 19

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

As disclosed in the Ministry of Finance’s and the Financial Management and

2022 Economic Outlook report, the Resilience Programme (“URUS”), as well

government implemented assistance and as extended a six-month moratorium on

economic stimulus packages totalling RM225 financing facilities for our retail customers

billion during the year to benefit over 20 and to boost the business resilience of

million people and 2.4 million businesses. small and medium enterprises (“SMEs”).

For Bank Muamalat Malaysia Berhad (“Bank Staying responsive to the needs and requests

Muamalat” or “the Bank”), our role was to of our customers, the Bank also improved

support the nation's transition through, and service delivery, nurtured people potential

out of, the economic crisis, by stepping up and strengthened operational capabilities. At

response to the government's call for banks to the same time, the Bank's strategic plan for

support and assist customers in their time of the future was reviewed in light of the broader

need. The Bank supported various deferment forces of change shaping the economic and

and assisted payment schemes such as Pakej financial landscape ahead.

Perlindungan Rakyat Dan Pemulihan Ekonomi

(“PEMULIH”), Targeted Payment Assistance, *Source: Department of Statistics, Malaysia

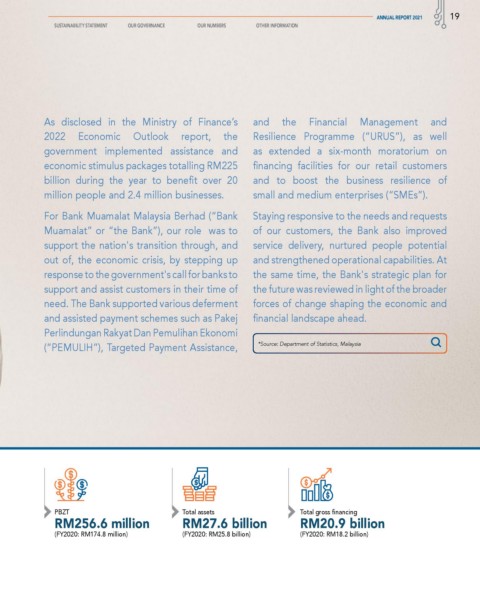

PBZT Total assets Total gross financing

RM256.6 million RM27.6 billion RM20.9 billion

(FY2020: RM174.8 million) (FY2020: RM25.8 billion) (FY2020: RM18.2 billion)