Page 16 - Bank-Muamalat-Annual-Report-2021

P. 16

14 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

ASSETS

PERFORMANCE

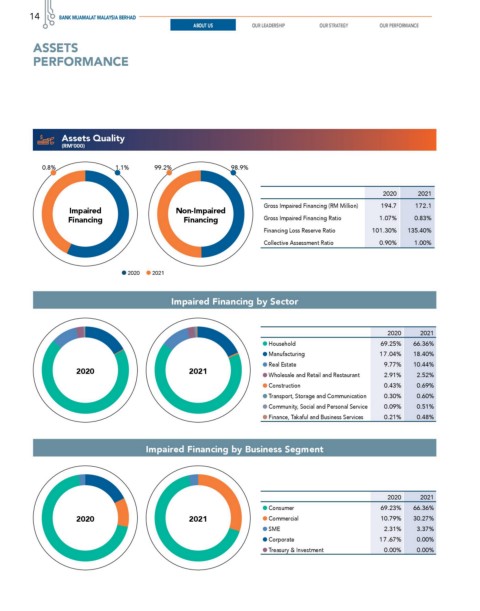

Assets Quality

(RM’000)

0.8% 1.1% 99.2% 98.9%

2020 2021

Gross Impaired Financing (RM Million) 194.7 172.1

Impaired Non-Impaired

Financing Financing Gross Impaired Financing Ratio 1.07% 0.83%

Financing Loss Reserve Ratio 101.30% 135.40%

Collective Assessment Ratio 0.90% 1.00%

2020 2021

Impaired Financing by Sector

2020 2021

Household 69.25% 66.36%

Manufacturing 17.04% 18.40%

Real Estate 9.77% 10.44%

2020 2021

Wholesale and Retail and Restaurant 2.91% 2.52%

Construction 0.43% 0.69%

Transport, Storage and Communication 0.30% 0.60%

Community, Social and Personal Service 0.09% 0.51%

Finance, Takaful and Business Services 0.21% 0.48%

Impaired Financing by Business Segment

2020 2021

Consumer 69.23% 66.36%

2020 2021 Commercial 10.79% 30.27%

SME 2.31% 3.37%

Corporate 17.67% 0.00%

Treasury & Investment 0.00% 0.00%