Page 75 - Bank-Muamalat-AR2020

P. 75

73

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Governance

INVESTMENT BANKING Fortifying financial access in the challenging year, IB continued

to prioritise serving the underserved communities as part

Challenges of the Bank’s commitment to Value-Based Intermediation.

IB continued its investment partnership with Permodalan

Investment Banking (“IB”) focuses on Islamic Capital Kelantan Berhad via MVSB, in the operation of Ar-Rahnu

Markets deals as well as managing the Bank’s private equity branches that provide instant and easy cash in rural parts of

investments via our private equity arm, Muamalat Venture Kelantan and Sabah. The venture generates sustainable returns

Sdn Bhd (“MVSB”).

to the Bank and allows us to promote fair and transparent

Capital Markets presented continued challenges during the products and services to underserved communities.

year, due to the pandemic-led contractions in economies and

the limited flow of new deals. However, Bank Muamalat’s Performance Review

IB team managed to turn in a commendable performance

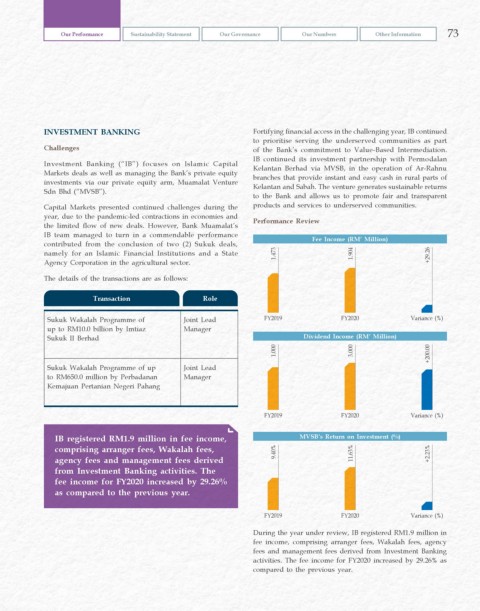

contributed from the conclusion of two (2) Sukuk deals, Fee Income (RM’ Million)

namely for an Islamic Financial Institutions and a State 1.473 1.904 +29.26

Agency Corporation in the agricultural sector.

The details of the transactions are as follows:

Transaction Role

Sukuk Wakalah Programme of Joint Lead FY2019 FY2020 Variance (%)

up to RM10.0 billion by Imtiaz Manager

Sukuk II Berhad Dividend Income (RM’ Million)

1.000 3.000 +200.00

Sukuk Wakalah Programme of up Joint Lead

to RM650.0 million by Perbadanan Manager

Kemajuan Pertanian Negeri Pahang

FY2019 FY2020 Variance (%)

IB registered RM1.9 million in fee income, MVSB’s Return on Investment (%)

comprising arranger fees, Wakalah fees, 9.40% 11.63% +2.23%

agency fees and management fees derived

from Investment Banking activities. The

fee income for FY2020 increased by 29.26%

as compared to the previous year.

FY2019 FY2020 Variance (%)

During the year under review, IB registered RM1.9 million in

fee income, comprising arranger fees, Wakalah fees, agency

fees and management fees derived from Investment Banking

activities. The fee income for FY2020 increased by 29.26% as

compared to the previous year.