Page 79 - Bank-Muamalat-AR2020

P. 79

77

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Governance

Muamalat Venture Sdn Bhd In line with VBI concept, MVSB In FY2020, MVSB registered profit

(“MVSB”) continues to serve the underserved before tax of RM5.9 million mainly

communities through its investment contributed by increase in profit

partnership with PKB in operating contribution from the Musyarakah

Ar-Rahnu branches in Kelantan investment.

and Sabah. The venture generates

REVENUE

RM sustainable returns to MVSB and allows Strategies Moving Forward For MVSB

8.5 Million us to promote fair and transparent

products and services to underserved

% communities especially during the The slowing domestic and global

132.4 Increase MCO period. economies due to COVID-19 pandemic

Year-on-Year (“y-o-y”) will continue to have a negative impact

Performance Review on the performance of companies across

various sectors. This in turn will affect

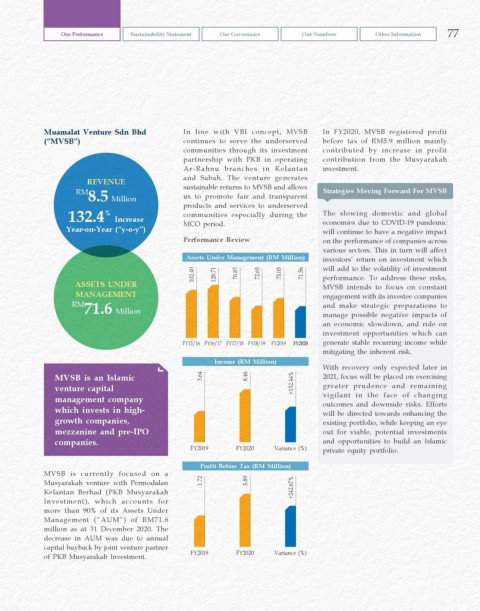

Assets Under Management (RM Million) investors’ return on investment which

102.40 128.71 76.83 72.65 75.05 71.56 will add to the volatility of investment

performance. To address these risks,

ASSETS UNDER MVSB intends to focus on constant

MANAGEMENT engagement with its investee companies

RM and make strategic preparations to

71.6 Million manage possible negative impacts of

an economic slowdown, and ride on

investment opportunities which can

FY15/16 FY16/17 FY17/18 FY18/19 FY2019 FY2020 generate stable recurring income while

mitigating the inherent risk.

Income (RM Million)

With recovery only expected later in

MVSB is an Islamic 3.64 8.46 2021, focus will be placed on exercising

venture capital +132.44% greater prudence and remaining

management company vigilant in the face of changing

outcomes and downside risks. Efforts

which invests in high- will be directed towards enhancing the

growth companies, existing portfolio, while keeping an eye

mezzanine and pre-IPO out for viable, potential investments

companies. and opportunities to build an Islamic

FY2019 FY2020 Variance (%) private equity portfolio.

Profit Before Tax (RM Million)

MVSB is currently focused on a

Musyarakah venture with Permodalan 1.72 5.89

Kelantan Berhad (PKB Musyarakah +242.67%

Investment), which accounts for

more than 90% of its Assets Under

Management (“AUM”) of RM71.6

million as at 31 December 2020. The

decrease in AUM was due to annual

capital buyback by joint venture partner

of PKB Musyarakah Investment. FY2019 FY2020 Variance (%)