Page 78 - Bank-Muamalat-AR2020

P. 78

76 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

About Us

ANNUAL REPORT FY2020

SUBSIDIARIES

Performance Review Strategies Moving Forward For MISB

For FY2020, MISB recorded a total revenue of RM4.8 million

and profit after tax of RM0.9 million. Shareholders’ funds of MISB is mindful of key determinants of equity market in the

MISB improved by 6%, contributed by profit after tax derived year 2021, such as:

for the year. MISB’s profit for the year was driven principally COVID-19 & Vaccines

by higher performance fees earned from both equity and

sukuk mandates, as the mandates generated higher-than- The outlook going forward is largely determined by the

benchmark returns for its clients, arising from opportunities risk of further resurgence of COVID-19 infections which

capitalised in both the equity and sukuk markets during the could lead to weaker business, employment and income

year. As at the end of FY2020, MISB recorded RM2.3 billion conditions. The progress of vaccination distribution and

in Assets Under Management (“AUM”). efficacy of vaccinations are other variables that need to be

monitored and responded to with agility. While the discovery

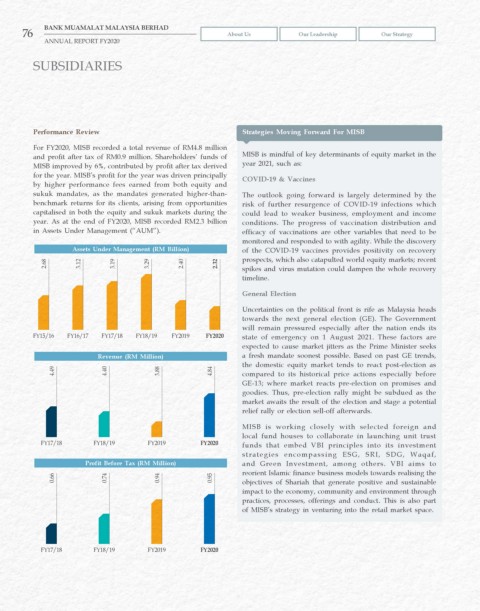

Assets Under Management (RM Billion) of the COVID-19 vaccines provides positivity on recovery

prospects, which also catapulted world equity markets; recent

2.68 3.12 3.19 3.29 2.40 2.32 spikes and virus mutation could dampen the whole recovery

timeline.

General Election

Uncertainties on the political front is rife as Malaysia heads

towards the next general election (GE). The Government

will remain pressured especially after the nation ends its

FY15/16 FY16/17 FY17/18 FY18/19 FY2019 FY2020 state of emergency on 1 August 2021. These factors are

expected to cause market jitters as the Prime Minister seeks

Revenue (RM Million) a fresh mandate soonest possible. Based on past GE trends,

the domestic equity market tends to react post-election as

4.49 4.40 3.88 4.84 compared to its historical price actions especially before

GE-13; where market reacts pre-election on promises and

goodies. Thus, pre-election rally might be subdued as the

market awaits the result of the election and stage a potential

relief rally or election sell-off afterwards.

MISB is working closely with selected foreign and

local fund houses to collaborate in launching unit trust

FY17/18 FY18/19 FY2019 FY2020 funds that embed VBI principles into its investment

strategies encompassing ESG, SRI, SDG, Waqaf,

Profit Before Tax (RM Million) and Green Investment, among others. VBI aims to

reorient Islamic finance business models towards realising the

0.66 0.74 0.94 0.95 objectives of Shariah that generate positive and sustainable

impact to the economy, community and environment through

practices, processes, offerings and conduct. This is also part

of MISB’s strategy in venturing into the retail market space.

FY17/18 FY18/19 FY2019 FY2020