Page 400 - Bank-Muamalat-AR2020

P. 400

398 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

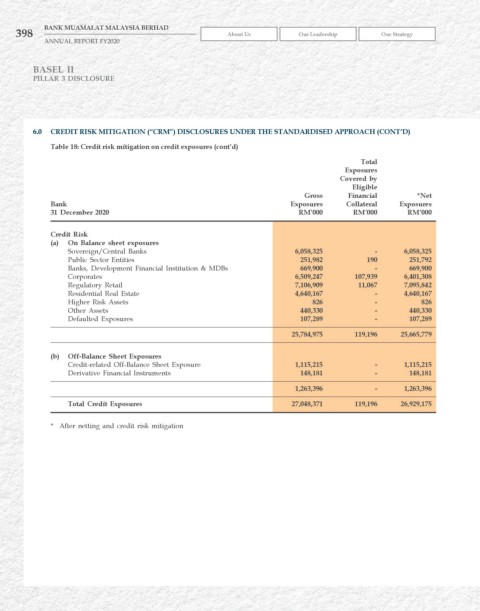

6.0 CrEDIT rISk MITIGATION (“CrM”) DISCLOSurES uNDEr ThE STANDArDISED APPrOACh (CONT’D)

Table 18: Credit risk mitigation on credit exposures (cont’d)

Total

Exposures

Covered by

Eligible

Gross Financial *Net

Bank Exposures Collateral Exposures

31 December 2020 rM’000 rM’000 rM’000

Credit risk

(a) On Balance sheet exposures

Sovereign/Central Banks 6,058,325 - 6,058,325

Public Sector Entities 251,982 190 251,792

Banks, Development Financial Institution & MDBs 669,900 - 669,900

Corporates 6,509,247 107,939 6,401,308

Regulatory Retail 7,106,909 11,067 7,095,842

Residential Real Estate 4,640,167 - 4,640,167

Higher Risk Assets 826 - 826

Other Assets 440,330 - 440,330

Defaulted Exposures 107,289 - 107,289

25,784,975 119,196 25,665,779

(b) Off-Balance Sheet Exposures

Credit-related Off-Balance Sheet Exposure 1,115,215 - 1,115,215

Derivative Financial Instruments 148,181 - 148,181

1,263,396 - 1,263,396

Total Credit Exposures 27,048,371 119,196 26,929,175

* After netting and credit risk mitigation