Page 399 - Bank-Muamalat-AR2020

P. 399

397

Our Performance Sustainability Statement Governance Our Numbers Other Information

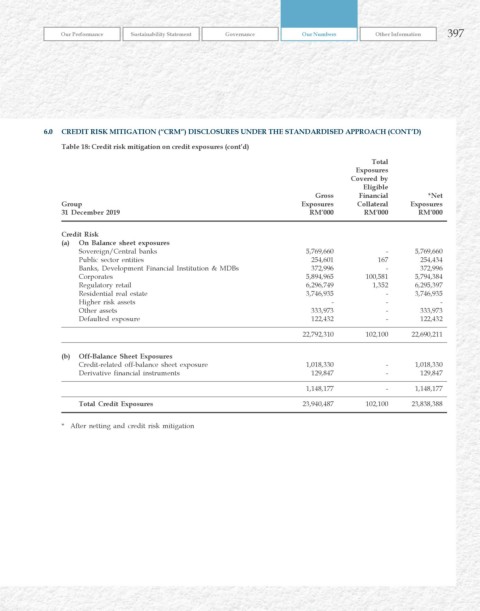

6.0 CrEDIT rISk MITIGATION (“CrM”) DISCLOSurES uNDEr ThE STANDArDISED APPrOACh (CONT’D)

Table 18: Credit risk mitigation on credit exposures (cont’d)

Total

Exposures

Covered by

Eligible

Gross Financial *Net

Group Exposures Collateral Exposures

31 December 2019 rM’000 rM’000 rM’000

Credit risk

(a) On Balance sheet exposures

Sovereign/Central banks 5,769,660 - 5,769,660

Public sector entities 254,601 167 254,434

Banks, Development Financial Institution & MDBs 372,996 - 372,996

Corporates 5,894,965 100,581 5,794,384

Regulatory retail 6,296,749 1,352 6,295,397

Residential real estate 3,746,935 - 3,746,935

Higher risk assets - - -

Other assets 333,973 - 333,973

Defaulted exposure 122,432 - 122,432

22,792,310 102,100 22,690,211

(b) Off-Balance Sheet Exposures

Credit-related off-balance sheet exposure 1,018,330 - 1,018,330

Derivative financial instruments 129,847 - 129,847

1,148,177 - 1,148,177

Total Credit Exposures 23,940,487 102,100 23,838,388

* After netting and credit risk mitigation