Page 397 - Bank-Muamalat-AR2020

P. 397

395

Our Performance Sustainability Statement Governance Our Numbers Other Information

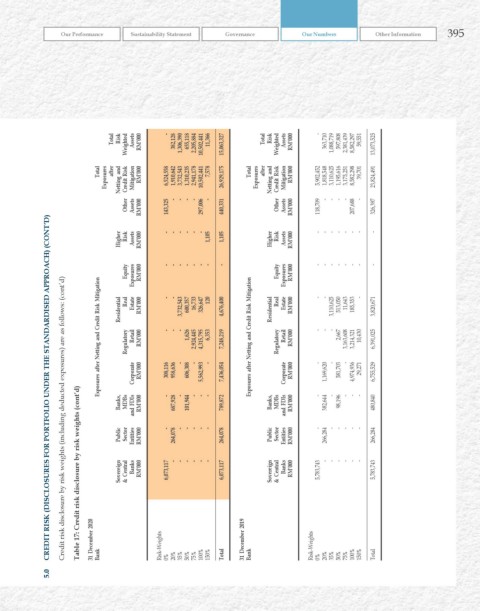

Total risk weighted Assets rM’000 - 382,128 1,306,390 655,118 2,205,884 10,502,441 11,366 15,063,327 Total risk weighted Assets rM’000 - 363,710 1,088,719 597,808 2,381,439 8,582,297 59,551 13,073,525

Total Exposures after and Netting Credit risk Mitigation rM’000 6,524,558 1,910,642 3,732,543 1,310,235 2,941,178 10,502,441 7,578 26,929,175 Total Exposures after and Netting Credit risk Mitigation rM’000 5,902,452 1,818,548 3,110,625 1,195,616 3,175,251 8,582,298 39,701 23,824,491

- - - - - - - - - -

Other Assets rM’000 143,325 297,006 440,331 Other Assets rM’000 118,709 207,688 326,397

CrEDIT rISk (DISCLOSurES FOr POrTFOLIO uNDEr ThE STANDArDISED APPrOACh) (CONT’D)

higher risk Assets rM’000 - - - - - - 1,105 1,105 higher risk Assets rM’000 - - - - - - - -

Equity real Exposures Estate rM’000 - - - - - - - 16,733 - - 120 - Equity real Exposures Estate rM’000 - - - - - - - 11,643 - - - -

Credit risk disclosure by risk weights (including deducted exposures) are as follows: (cont’d)

Exposures after Netting and Credit risk Mitigation residential regulatory retail rM’000 rM’000 - 308,116 - 958,636 3,732,543 - - 600,357 1,626 606,308 2,924,445 - 326,647 4,315,795 6,353 - 4,676,400 7,248,219 Exposures after Netting and Credit risk Mitigation residential regulatory retail rM’000 rM’000 - - - 3,110,625 - - 513,050 2,667 58

Table 17: Credit risk disclosure by risk weights (cont’d)

Banks, MDBs Corporate FDIs rM’000 rM’000 - 687,928 - 101,944 - 5,562,993 - - 7,436,054 789,872 Banks, MDBs Corporate FDIs rM’000 rM’000 - 1,169,620 382,644 - 98,196 - 4,974,936 - - 6,755,529 480,840

and and

Public Sector Entities rM’000 - 264,078 - - - - - 264,078 Public Sector Entities rM’000 - 266,284 - - - - - 266,284

Sovereign & Central Banks rM’000 6,073,117 - - - - - - 6,073,117 Sovereign & Central Banks rM’000 5,783,743 - - - - - - 5,783,743

31 December 2020 Bank Risk-Weights 20% 35% 50% 75% 100% 150% Total 31 December 2019 Bank Risk-Weights 20% 35% 50% 75% 100% 150% Total

5.0 0% 0%