Page 392 - Bank-Muamalat-AR2020

P. 392

390 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

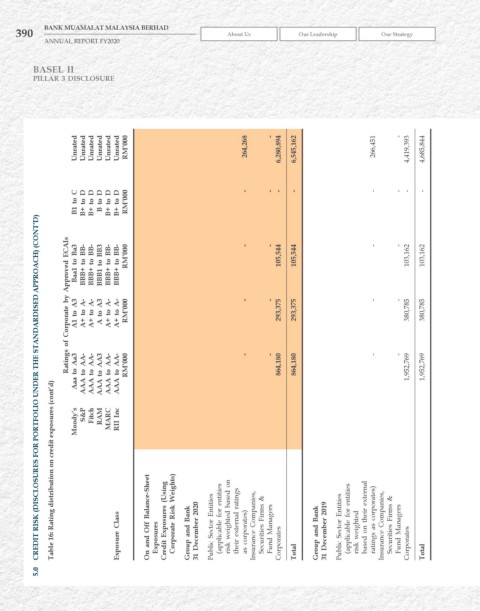

unrated unrated unrated unrated unrated unrated rM’000 264,268 - 6,280,894 6,545,162 266,451 - 4,419,393 4,685,844

B1 to C B+ to D B+ to D B to D B+ to D B+ to D rM’000 - - - - - - - -

CrEDIT rISk (DISCLOSurES FOr POrTFOLIO uNDEr ThE STANDArDISED APPrOACh) (CONT’D)

Baa1 to Ba3 BBB+ to BB- BBB+ to BB- BBB1 to BB3 BBB+ to BB- BBB+ to BB- rM’000 - - 105,544 105,544 - - 103,162 103,162

A1 to A3 ratings of Corporate by Approved ECAIs A+ to A- A+ to A- A to A3 A+ to A- A+ to A- rM’000 - - 293,375 293,375 - - 380,785 380,785

Aaa to Aa3 AAA to AA- AAA to AA- AAA to AA3 AAA to AA- AAA to AA- rM’000 - - 864,180 864,180 - - 1,952,769 1,952,769

Table 16: rating distribution on credit exposures (cont’d)

Moody’s S&P Fitch rAM MArC rII Inc

Exposure Class On and Off Balance-Sheet Exposures Credit Exposures (using Corporate risk weights) Group and Bank 31 December 2020 Public Sector Entities (applicable for entities risk weighted based on their external ratings as corporates) Insurance Companies, Securities Firms & Fund Managers Corporates Group and Bank 31 December 2019 Public Sector Entities (applicable for entities risk weighted based on their external rat

Total Total

5.0