Page 391 - Bank-Muamalat-AR2020

P. 391

389

Our Performance Sustainability Statement Governance Our Numbers Other Information

Each ECAI is used based on the types of exposures as described per Capital Adequacy Framework for Islamic Banks (CAFIB). The Group’s and

the Bank’s credit exposures that are presently not mapped to the ECAI ratings are depicted below as unrated. Rating for financing exposure

The Group and the Bank use the external rating agencies such as MARC, RAM, Moody’s, Standard & Poors, Fitch and R&I for rating of

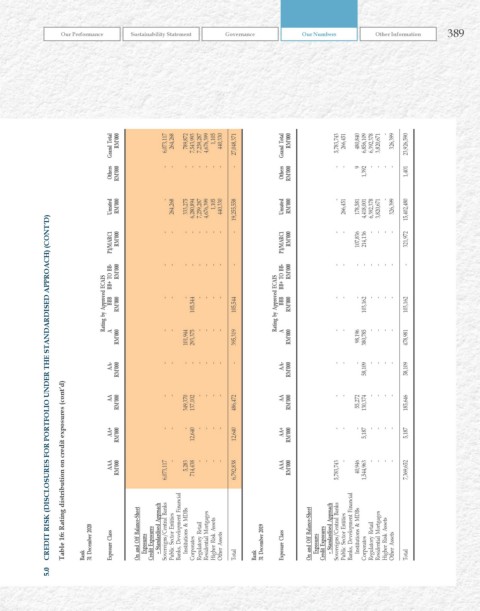

Grand Total rM’000 6,073,117 264,268 789,872 7,559,097 7,259,287 4,676,399 1,105 440,330 27,063,475 Grand Total rM’000 5,783,743 266,451 480,840 6,870,006 6,392,378 3,820,671 - 326,399 23,940,488 Grand Total rM’000 6,073,117 264,268 789,872 7,543,993 7,259,287 4,676,399 1,105 440,330 27,048,371 Grand Total rM’000 5,783,743 266,451 480,840 6,856,109 6,392,378 3,820,671 - 326

Others rM’000 - - - - - - - - - Others rM’000 - - 9 1,392 - - - - 1,401 Others rM’000 - - - - - - - - - Others rM’000 - - 9 1,392 - - - - 1,401

unrated rM’000 - 264,268 333,275 6,295,998 7,259,287 4,676,399 1,105 440,330 19,270,662 unrated rM’000 - 266,451 178,581 4,431,898 6,392,378 3,820,671 - 326,399 15,416,377 unrated rM’000 - 264,268 333,275 6,280,894 7,259,287 4,676,399 1,105 440,330 19,255,558 unrated rM’000 - 266,451 178,581 4,418,001 6,392,378 3,820,671 - 326,399 15,402,48

commercial papers (CPs) and corporate bonds (CBs) or participation of syndication or underwriting of PDS issuance.

P1/MArC1 rM’000 rM’000 - - - - - - - - - - - - - - - - - - P1/MArC1 rM’000 rM’000 - - - - 107,836 - 214,136 - - - - - - - - - 321,972 - P1/MArC1 rM’000 rM’000 - - - - - - - - - - - - - - - - - - P1/MArC1 rM’000 rM’000 - - - - 107,836 - 21

CrEDIT rISk (DISCLOSurES FOr POrTFOLIO uNDEr ThE STANDArDISED APPrOACh)

rating by Approved ECAIS BB+ TO BB- BBB rM’000 - - - 105,544 - - - - 105,544 rating by Approved ECAIS BB+ TO BB- BBB rM’000 - - - 103,162 - - - - 103,162 rating by Approved ECAIS BB+ TO BB- BBB rM’000 - - - 105,544 - - - - 105,544 rating by Approved ECAIS BB+ TO BB- BBB rM’000 - - - 103,162 - - - - 103,162

based on the obligor rating and treasury exposure based on issue rating of the exposure.

rM’000 A - - 101,944 293,375 - - - - 395,319 A rM’000 - - 98,196 380,785 - - - - 478,981 A rM’000 - - 101,944 293,375 - - - - 395,319 A rM’000 - - 98,196 380,785 - - - - 478,981

AA- rM’000 - - - - - - - - - AA- rM’000 - - - 58,109 - - - - 58,109 AA- rM’000 - - - - - - - - - AA- rM’000 - - - 58,109 - - - - 58,109

AA - - - - - - AA - - - - - - CrEDIT rISk (DISCLOSurES FOr POrTFOLIO uNDEr ThE STANDArDISED APPrOACh) (CONT’D) AA - - - - - - AA - - - - - -

rM’000 349,370 137,102 486,472 rM’000 55,272 130,374 185,646 rM’000 349,370 137,102 486,472 rM’000 55,272 130,374 185,646

Table 16: rating distribution on credit exposures

AA+ rM’000 - - - 12,640 - - - - 12,640 AA+ rM’000 - - - 5,187 - - - - 5,187 AA+ rM’000 - - - 12,640 - - - - 12,640 AA+ rM’000 - - - 5,187 - - - - 5,187

AAA rM’000 6,073,117 - 5,283 714,438 - - - - 6,792,838 AAA rM’000 5,783,743 - 40,946 1,544,963 - - - - 7,369,652 Table 16: rating distribution on credit exposures (cont’d) AAA rM’000 6,073,117 - 5,283 714,438 - - - - 6,792,838 AAA rM’000 5,783,743 - 40,946 1,544,963 - - - - 7,369,652

31 December 2020 Exposure Class On and Off Balance-Sheet Exposures Credit Exposures – Standardised Approach Sovereigns/Central Banks Public Sector Entities Banks, Development Financial Institutions & MDBs Corporates Regulatory Retail Residential Mortgages Higher Risk Assets Other Assets 31 December 2019 Exposure Class On and Off Balance-Sheet Exposures Credit Exposures – Standardised Approach Sovereigns/Central Banks Public Sector Entities Banks, Deve

Group Total Group Total Bank Total Bank Total

5.0 5.0