Page 404 - Bank-Muamalat-AR2020

P. 404

402 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

7.0 GENErAL DISCLOSurE FOr OFF-BALANCE ShEET ExPOSurE AND COuNTErPArTy CrEDIT rISk (“CCr”)

(CONT’D.)

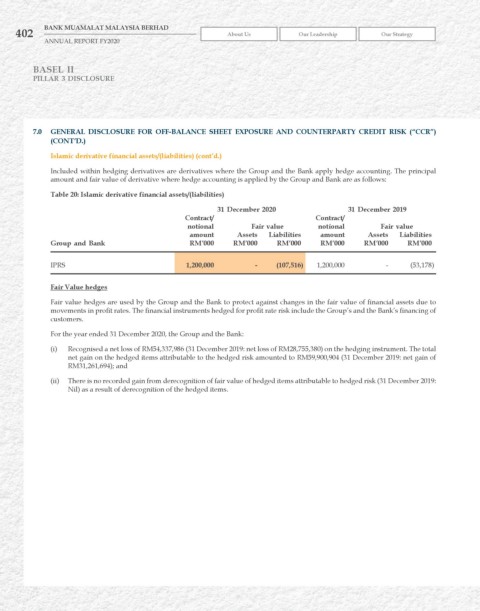

Islamic derivative financial assets/(liabilities) (cont’d.)

Included within hedging derivatives are derivatives where the Group and the Bank apply hedge accounting. The principal

amount and fair value of derivative where hedge accounting is applied by the Group and Bank are as follows:

Table 20: Islamic derivative financial assets/(liabilities)

31 December 2020 31 December 2019

Contract/ Contract/

notional Fair value notional Fair value

amount Assets Liabilities amount Assets Liabilities

Group and Bank rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

IPRS 1,200,000 - (107,516) 1,200,000 - (53,178)

Fair value hedges

Fair value hedges are used by the Group and the Bank to protect against changes in the fair value of financial assets due to

movements in profit rates. The financial instruments hedged for profit rate risk include the Group’s and the Bank’s financing of

customers.

For the year ended 31 December 2020, the Group and the Bank:

(i) Recognised a net loss of RM54,337,986 (31 December 2019: net loss of RM28,755,380) on the hedging instrument. The total

net gain on the hedged items attributable to the hedged risk amounted to RM59,900,904 (31 December 2019: net gain of

RM31,261,694); and

(ii) There is no recorded gain from derecognition of fair value of hedged items attributable to hedged risk (31 December 2019:

Nil) as a result of derecognition of the hedged items.