Page 217 - Bank-Muamalat-AR2020

P. 217

215

Our Performance Sustainability Statement Governance Our Numbers Other Information

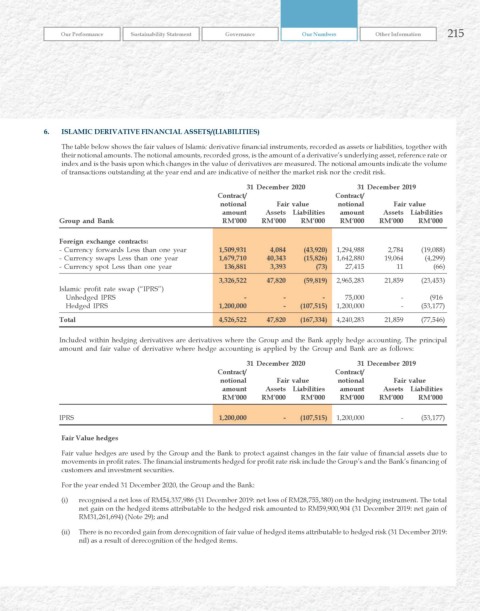

6. ISLAMIC DErIvATIvE FINANCIAL ASSETS/(LIABILITIES)

The table below shows the fair values of Islamic derivative financial instruments, recorded as assets or liabilities, together with

their notional amounts. The notional amounts, recorded gross, is the amount of a derivative’s underlying asset, reference rate or

index and is the basis upon which changes in the value of derivatives are measured. The notional amounts indicate the volume

of transactions outstanding at the year end and are indicative of neither the market risk nor the credit risk.

31 December 2020 31 December 2019

Contract/ Contract/

notional Fair value notional Fair value

amount Assets Liabilities amount Assets Liabilities

Group and Bank rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

Foreign exchange contracts:

- Currency forwards Less than one year 1,509,931 4,084 (43,920) 1,294,988 2,784 (19,088)

- Currency swaps Less than one year 1,679,710 40,343 (15,826) 1,642,880 19,064 (4,299)

- Currency spot Less than one year 136,881 3,393 (73) 27,415 11 (66)

3,326,522 47,820 (59,819) 2,965,283 21,859 (23,453)

Islamic profit rate swap (“IPRS”)

Unhedged IPRS - - - 75,000 - (916

Hedged IPRS 1,200,000 - (107,515) 1,200,000 - (53,177)

Total 4,526,522 47,820 (167,334) 4,240,283 21,859 (77,546)

Included within hedging derivatives are derivatives where the Group and the Bank apply hedge accounting. The principal

amount and fair value of derivative where hedge accounting is applied by the Group and Bank are as follows:

31 December 2020 31 December 2019

Contract/ Contract/

notional Fair value notional Fair value

amount Assets Liabilities amount Assets Liabilities

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

IPRS 1,200,000 - (107,515) 1,200,000 - (53,177)

Fair value hedges

Fair value hedges are used by the Group and the Bank to protect against changes in the fair value of financial assets due to

movements in profit rates. The financial instruments hedged for profit rate risk include the Group’s and the Bank’s financing of

customers and investment securities.

For the year ended 31 December 2020, the Group and the Bank:

(i) recognised a net loss of RM54,337,986 (31 December 2019: net loss of RM28,755,380) on the hedging instrument. The total

net gain on the hedged items attributable to the hedged risk amounted to RM59,900,904 (31 December 2019: net gain of

RM31,261,694) (Note 29); and

(ii) There is no recorded gain from derecognition of fair value of hedged items attributable to hedged risk (31 December 2019:

nil) as a result of derecognition of the hedged items.