Page 212 - Bank-Muamalat-AR2020

P. 212

210 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

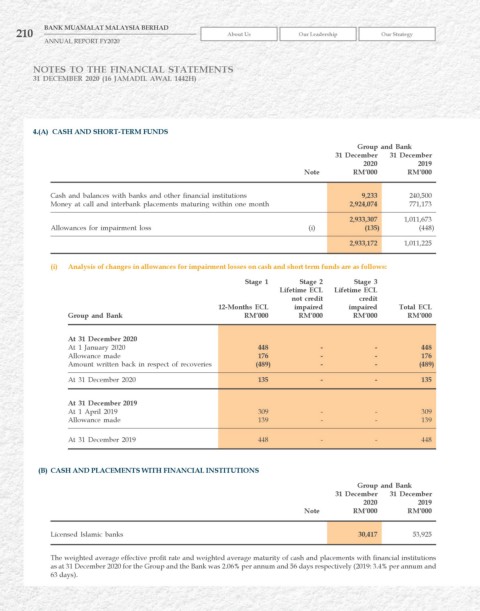

4.(A) CASh AND ShOrT-TErM FuNDS

Group and Bank

31 December 31 December

2020 2019

Note rM’000 rM’000

Cash and balances with banks and other financial institutions 9,233 240,500

Money at call and interbank placements maturing within one month 2,924,074 771,173

2,933,307 1,011,673

Allowances for impairment loss (i) (135) (448)

2,933,172 1,011,225

(i) Analysis of changes in allowances for impairment losses on cash and short term funds are as follows:

Stage 1 Stage 2 Stage 3

Lifetime ECL Lifetime ECL

not credit credit

12-Months ECL impaired impaired Total ECL

Group and Bank rM’000 rM’000 rM’000 rM’000

At 31 December 2020

At 1 January 2020 448 - - 448

Allowance made 176 - - 176

Amount written back in respect of recoveries (489) - - (489)

At 31 December 2020 135 - - 135

At 31 December 2019

At 1 April 2019 309 - - 309

Allowance made 139 - - 139

At 31 December 2019 448 - - 448

(B) CASh AND PLACEMENTS wITh FINANCIAL INSTITuTIONS

Group and Bank

31 December 31 December

2020 2019

Note rM’000 rM’000

Licensed Islamic banks 30,417 53,925

The weighted average effective profit rate and weighted average maturity of cash and placements with financial institutions

as at 31 December 2020 for the Group and the Bank was 2.06% per annum and 56 days respectively (2019: 3.4% per annum and

63 days).