Page 209 - Bank-Muamalat-AR2020

P. 209

207

Our Performance Sustainability Statement Governance Our Numbers Other Information

2. SIGNIFICANT ACCOuNTING POLICIES (CONT’D.)

2.5 Significant changes in regulatory requirements (cont’d.)

(b) Measures announced by BNM to assist individuals, small-medium enterprises (“SMEs”) and corporates affected

by COvID-19 (cont’d.)

Payment assistance and classification in the Central Credit Reference Information System (“CCRIS”)

Recognising the challenging environment, financial institutions are granting additional payment assistance for

individuals and SMEs whose income have been affected by the pandemic, to support economic recovery and

safeguard livelihood of Malaysians.

The assistance is extended to facilities approved before 1 October 2020, which are not in arrears of more than 90

days at the time a customer requests for payment assistance. The additional payment assistance will be available to

eligible customers until 30 June 2021.

The payment assistance does not automatically result in stage transfer under MFRS 9 in the absence of other factors

indicating evidence of significant increase in credit risk (“SICR”). Judgement and more holistic assessment of all

relevant indicators and information, such as, historical payment and delinquency trend pre-COVID-19 pandemic,

are applied in determining SICR. In addition, the financing that is approved under payment assistance is exempted

to be reported as rescheduling and restructuring (“R&R”) and credit impaired in CCRIS.

Supervisory and Prudential Measures

During the financial year ended 31 December 2020, financial institutions are allowed to operate below the minimum

Net Stable Funding Ratio and Liquidity Coverage Ratio of 100%, draw down the capital conservation buffer of 2.5%

and reduce the regulatory reserves held against expected losses to 0%. However, financial institutions are expected

to restore their buffer to the minimum regulatory requirement by 30 September 2021.

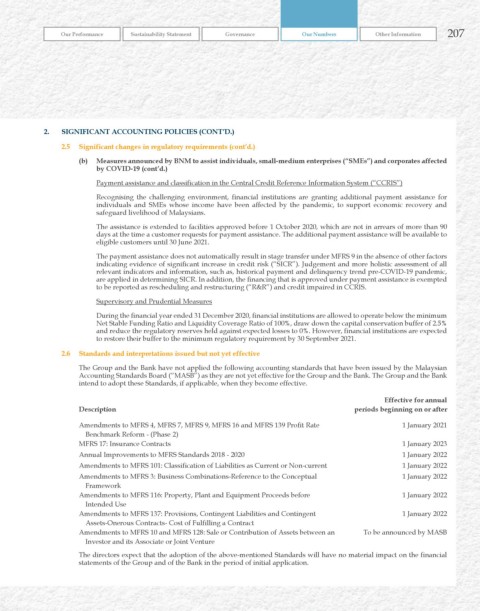

2.6 Standards and interpretations issued but not yet effective

The Group and the Bank have not applied the following accounting standards that have been issued by the Malaysian

Accounting Standards Board (“MASB”) as they are not yet effective for the Group and the Bank. The Group and the Bank

intend to adopt these Standards, if applicable, when they become effective.

Effective for annual

Description periods beginning on or after

Amendments to MFRS 4, MFRS 7, MFRS 9, MFRS 16 and MFRS 139 Profit Rate 1 January 2021

Benchmark Reform - (Phase 2)

MFRS 17: Insurance Contracts 1 January 2023

Annual Improvements to MFRS Standards 2018 - 2020 1 January 2022

Amendments to MFRS 101: Classification of Liabilities as Current or Non-current 1 January 2022

Amendments to MFRS 3: Business Combinations-Reference to the Conceptual 1 January 2022

Framework

Amendments to MFRS 116: Property, Plant and Equipment Proceeds before 1 January 2022

Intended Use

Amendments to MFRS 137: Provisions, Contingent Liabilities and Contingent 1 January 2022

Assets-Onerous Contracts- Cost of Fulfilling a Contract

Amendments to MFRS 10 and MFRS 128: Sale or Contribution of Assets between an To be announced by MASB

Investor and its Associate or Joint Venture

The directors expect that the adoption of the above-mentioned Standards will have no material impact on the financial

statements of the Group and of the Bank in the period of initial application.