Page 220 - Bank-Muamalat-AR2020

P. 220

218 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

Notes to the fiNaNcial statemeNts

31 December 2020 (16 JamaDil awal 1442h)

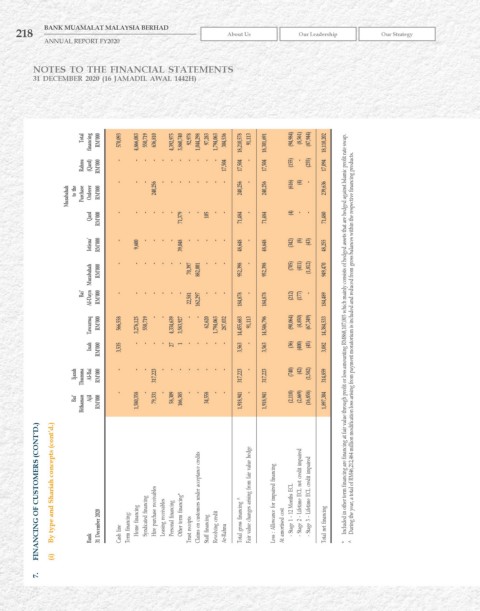

Total financing rM’000 570,093 4,866,083 550,719 636,810 4,392,975 3,860,740 92,978 1,044,298 97,283 1,794,063 304,536 18,210,578 91,113 18,301,691 (94,984) (8,561) (87,944) 18,110,202

rahnu (qard) rM’000 - - - - - - - - - - - 17,504 17,504 - 17,504 (155) - (255) 17,094

- - - 240,256 - - - - - - - - 240,256 - 240,256 (616) (4) - 239,636

Murabahah the to Purchase Orderer rM’000

qard rM’000 - - - - - - 71,379 - - 105 - - 71,484 - 71,484 (4) - - 71,480

Istisna’ rM’000 - 9,600 - - - - 39,048 - - - - - 48,648 - 48,648 (342) (8) (43) 48,255

- - - - - - - - - - - (705) (411) (1,812)

Murabahah rM’000 70,397 882,001 952,398 952,398 949,470

Al-Dayn 22,581 162,297 184,878 184,878 184,489

Bai’ rM’000 - - - - - - - - - - - (212) (177) -

Tawarruq rM’000 566,558 3,276,125 550,719 - - 4,334,639 3,583,927 - - 62,620 1,794,063 287,032 14,455,683 91,113 14,546,796 (90,064) (4,850) (67,349) 14,384,533 Included in other term financing are financing at fair value through profit or loss amounting RM868,107,003 which mainly consists of hedged assets that are hedged against Islamic profit rate swap.

Inah rM’000 3,535 - - - - 27 1 - - - - - 3,563 - 3,563 (36) (400) (45) 3,082 During the year, a total of RM46,212,464 million modification loss arising from payment moratorium is included and reduced from gross balances within the respective financing products.

Ijarah Thumma Al-Bai rM’000 - - - 317,223 - - - - - - - - 317,223 - 317,223 (740) (42) (1,582) 314,859

- - - - - - - -

Bithaman

Bai’ Ajil rM’000 1,580,358 79,331 58,309 166,385 34,558 1,918,941 1,918,941 (2,110) (2,669) (16,858) 1,897,304

By type and Shariah concepts (cont’d.) Syndicated financing Hire purchase receivables Leasing receivables Personal financing Other term financing* Claims on customers under acceptance credits Total gross financing ^ Fair value changes arising from fair value hedge Less : Allowance for impaired financing - Stage 1 - 12 Months ECL - Stage 2 - Lifetime ECL not credit impaired - Stage 3 - Lifetime ECL credit impaired

FINANCING OF CuSTOMErS (CONT’D.)

(i) Bank 31 December 2020 Cash line Term financing: Home financing Trust receipts Staff financing Revolving credit Ar-Rahnu At amortised cost Total net financing * ^

7.