Page 221 - Bank-Muamalat-AR2020

P. 221

219

Our Performance Sustainability Statement Governance Our Numbers Other Information

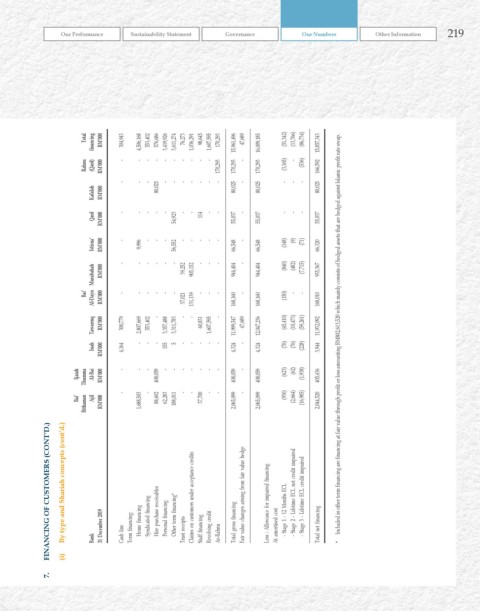

Total financing rM’000 304,943 4,506,168 553,402 576,686 3,419,926 3,611,274 76,273 1,036,291 98,645 1,607,595 170,293 15,961,496 47,689 16,009,185 (51,342) (13,766) (86,734) 15,857,343

rahnu (qard) rM’000 - - - - - - - - - - 170,293 170,293 - 170,293 (3,165) - (536) 166,592

- - - 80,025 - - - - - - - 80,025 - 80,025 - - - 80,025

kafalah rM’000

qard rM’000 - - - - - 54,923 - - 114 - - 55,037 - 55,037 - - - 55,037

Istisna’ rM’000 - 9,996 - - - 56,552 - - - - - 66,548 - 66,548 (148) (9) (71) 66,320

Murabahah rM’000 - - - - - - 39,252 905,152 - - - 944,404 - 944,404 (840) (482) (7,715) 935,367

Al-Dayn 37,021 131,139 168,160 168,160 168,010

Bai’ rM’000 - - - - - - - - - - (150) - -

Tawarruq rM’000 300,779 2,807,669 553,402 - 3,357,488 3,311,783 - - 60,831 1,607,595 - 11,999,547 47,689 12,047,236 (45,410) (10,473) (59,261) 11,932,092 Included in other term financing are financing at fair value through profit or loss amounting RM802,613,520 which mainly consists of hedged assets that are hedged against Islamic profit rate swap.

Inah rM’000 4,164 - - - 155 5 - - - - - 4,324 - 4,324 (76) (76) (228) 3,944

Ijarah Thumma Al-Bai rM’000 - - - 408,059 - - - - - - - 408,059 - 408,059 (623) (62) (1,938) 405,436

Bai’ Ajil rM’000 - 1,688,503 - 88,602 62,283 188,011 - - 37,700 - - 2,065,099 - 2,065,099 (930) (2,664) (16,985) 2,044,520

Bithaman

FINANCING OF CuSTOMErS (CONT’D.)

By type and Shariah concepts (cont’d.) financing financing Hire purchase receivables financing Other term financing* Claims on customers under acceptance credits credit Fair value changes arising from fair value hedge Less : Allowance for impaired financing - Stage 1 - 12 Months ECL - Stage 2 - Lifetime ECL not credit impaired - Stage 3 - Lifetime ECL credit impaired

(i) Bank 31 December 2019 line Cash Term financing: Home Syndicated Personal receipts Trust financing Staff Revolving Ar-Rahnu Total gross financing At amortised cost Total net financing *

7.