Page 138 - Bank-Muamalat-AR2020

P. 138

136 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

About Us

ANNUAL REPORT FY2020

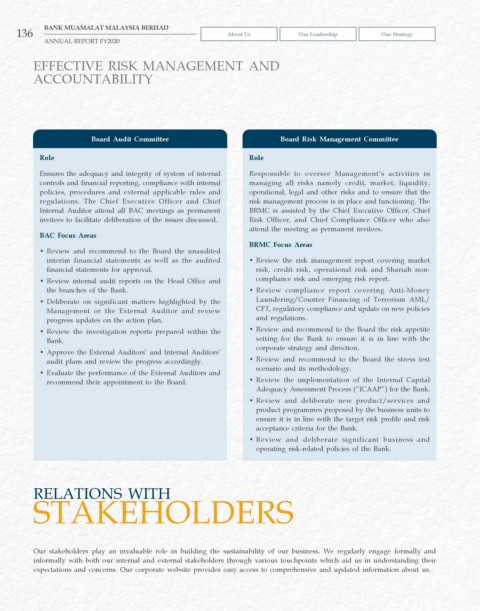

EFFECTIVE RISK MANAGEMENT AND

ACCOUNTABILITY

Board Audit Committee Board Risk Management Committee

Role Role

Ensures the adequacy and integrity of system of internal Responsible to oversee Management’s activities in

controls and financial reporting, compliance with internal managing all risks namely credit, market, liquidity,

policies, procedures and external applicable rules and operational, legal and other risks and to ensure that the

regulations. The Chief Executive Officer and Chief risk management process is in place and functioning. The

Internal Auditor attend all BAC meetings as permanent BRMC is assisted by the Chief Executive Officer, Chief

invitees to facilitate deliberation of the issues discussed. Risk Officer, and Chief Compliance Officer who also

attend the meeting as permanent invitees.

BAC Focus Areas

BRMC Focus Areas

• Review and recommend to the Board the unaudited

interim financial statements as well as the audited • Review the risk management report covering market

financial statements for approval. risk, credit risk, operational risk and Shariah non-

• Review internal audit reports on the Head Office and compliance risk and emerging risk report.

the branches of the Bank. • Review compliance report covering Anti-Money

• Deliberate on significant matters highlighted by the Laundering/Counter Financing of Terrorism AML/

Management or the External Auditor and review CFT, regulatory compliance and update on new policies

progress updates on the action plan. and regulations.

• Review the investigation reports prepared within the • Review and recommend to the Board the risk appetite

Bank. setting for the Bank to ensure it is in line with the

corporate strategy and direction.

• Approve the External Auditors’ and Internal Auditors’

audit plans and review the progress accordingly. • Review and recommend to the Board the stress test

scenario and its methodology.

• Evaluate the performance of the External Auditors and

recommend their appointment to the Board. • Review the implementation of the Internal Capital

Adequacy Assessment Process (“ICAAP”) for the Bank.

• Review and deliberate new product/services and

product programmes proposed by the business units to

ensure it is in line with the target risk profile and risk

acceptance criteria for the Bank.

• Review and deliberate significant business and

operating risk-related policies of the Bank.

RELATIONS WITH

STAKEHOLDERS

Our stakeholders play an invaluable role in building the sustainability of our business. We regularly engage formally and

informally with both our internal and external stakeholders through various touchpoints which aid us in understanding their

expectations and concerns. Our corporate website provides easy access to comprehensive and updated information about us.