Page 374 - Bank-Muamalat_Annual-Report-2023

P. 374

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

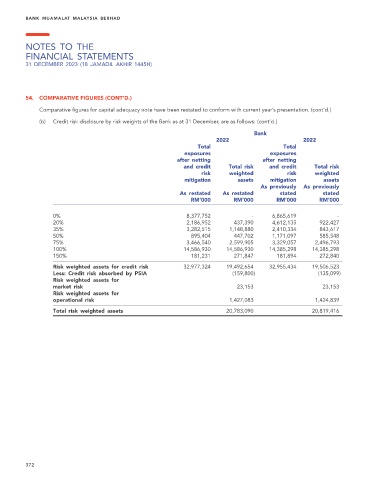

54. COMPARATIVE FIGURES (CONT’D.)

Comparative figures for capital adequacy note have been restated to conform with current year’s presentation. (cont’d.)

(b) Credit risk disclosure by risk weights of the Bank as at 31 December, are as follows: (cont’d.)

Bank

2022 2022

Total Total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

As previously As previously

As restated As restated stated stated

RM’000 RM’000 RM’000 RM’000

0% 8,377,752 - 6,865,619 -

20% 2,186,952 437,390 4,612,135 922,427

35% 3,282,515 1,148,880 2,410,334 843,617

50% 895,404 447,702 1,171,097 585,548

75% 3,466,540 2,599,905 3,329,057 2,496,793

100% 14,586,930 14,586,930 14,385,298 14,385,298

150% 181,231 271,847 181,894 272,840

Risk weighted assets for credit risk 32,977,324 19,492,654 32,955,434 19,506,523

Less: Credit risk absorbed by PSIA (159,800) (135,099)

Risk weighted assets for

market risk 23,153 23,153

Risk weighted assets for

operational risk 1,427,083 1,424,839

Total risk weighted assets 20,783,090 20,819,416

372