Page 371 - Bank-Muamalat_Annual-Report-2023

P. 371

ANNUAL REPORT 2023

OUR NUMBERS

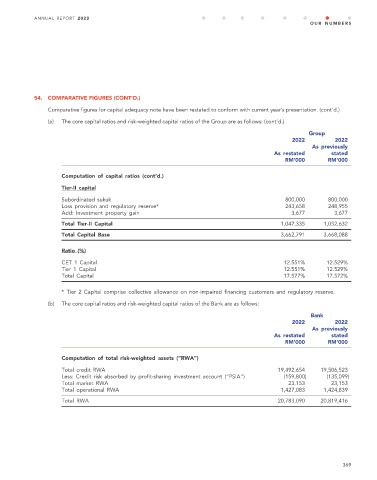

54. COMPARATIVE FIGURES (CONT’D.)

Comparative figures for capital adequacy note have been restated to conform with current year’s presentation. (cont’d.)

(a) The core capital ratios and risk-weighted capital ratios of the Group are as follows: (cont’d.)

Group

2022 2022

As previously

As restated stated

RM’000 RM’000

Computation of capital ratios (cont’d.)

Tier-II capital

Subordinated sukuk 800,000 800,000

Loss provision and regulatory reserve* 243,658 248,955

Add: Investment property gain 3,677 3,677

Total Tier-II Capital 1,047,335 1,052,632

Total Capital Base 3,662,791 3,668,088

Ratio (%)

CET 1 Capital 12.551% 12.529%

Tier 1 Capital 12.551% 12.529%

Total Capital 17.577% 17.572%

* Tier 2 Capital comprise collective allowance on non-impaired financing customers and regulatory reserve.

(b) The core capital ratios and risk-weighted capital ratios of the Bank are as follows:

Bank

2022 2022

As previously

As restated stated

RM’000 RM’000

Computation of total risk-weighted assets (“RWA”)

Total credit RWA 19,492,654 19,506,523

Less: Credit risk absorbed by profit-sharing investment account (“PSIA”) (159,800) (135,099)

Total market RWA 23,153 23,153

Total operational RWA 1,427,083 1,424,839

Total RWA 20,783,090 20,819,416

369