Page 360 - Bank-Muamalat_Annual-Report-2023

P. 360

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

51. CAPITAL ADEQUACY (CONT’D.)

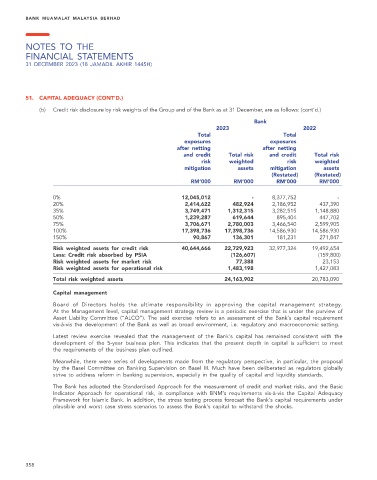

(b) Credit risk disclosure by risk weights of the Group and of the Bank as at 31 December, are as follows: (cont’d.)

Bank

2023 2022

Total Total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

(Restated) (Restated)

RM’000 RM’000 RM’000 RM’000

0% 12,045,012 - 8,377,752 -

20% 2,414,622 482,924 2,186,952 437,390

35% 3,749,471 1,312,315 3,282,515 1,148,880

50% 1,239,287 619,644 895,404 447,702

75% 3,706,671 2,780,003 3,466,540 2,599,905

100% 17,398,736 17,398,736 14,586,930 14,586,930

150% 90,867 136,301 181,231 271,847

Risk weighted assets for credit risk 40,644,666 22,729,923 32,977,324 19,492,654

Less: Credit risk absorbed by PSIA (126,607) (159,800)

Risk weighted assets for market risk 77,388 23,153

Risk weighted assets for operational risk 1,483,198 1,427,083

Total risk weighted assets 24,163,902 20,783,090

Capital management

Board of Directors holds the ultimate responsibility in approving the capital management strategy.

At the Management level, capital management strategy review is a periodic exercise that is under the purview of

Asset Liability Committee (“ALCO”). The said exercise refers to an assessment of the Bank’s capital requirement

vis-à-vis the development of the Bank as well as broad environment, i.e. regulatory and macroeconomic setting.

Latest review exercise revealed that the management of the Bank’s capital has remained consistent with the

development of the 5-year business plan. This indicates that the present depth in capital is sufficient to meet

the requirements of the business plan outlined.

Meanwhile, there were series of developments made from the regulatory perspective, in particular, the proposal

by the Basel Committee on Banking Supervision on Basel III. Much have been deliberated as regulators globally

strive to address reform in banking supervision, especially in the quality of capital and liquidity standards.

The Bank has adopted the Standardised Approach for the measurement of credit and market risks, and the Basic

Indicator Approach for operational risk, in compliance with BNM’s requirements vis-à-vis the Capital Adequacy

Framework for Islamic Bank. In addition, the stress testing process forecast the Bank’s capital requirements under

plausible and worst case stress scenarios to assess the Bank’s capital to withstand the shocks.

358