Page 365 - Bank-Muamalat_Annual-Report-2023

P. 365

ANNUAL REPORT 2023

OUR NUMBERS

53. SHARIAH DISCLOSURES (CONT’D.)

(b) Recognition and measurement by main class of Shariah contracts

The recognition and measurement of each main class of Shariah contract is dependent on the nature of the

products, either financing or deposit product. The accounting policies for each of these products are disclosed in

their respective policies.

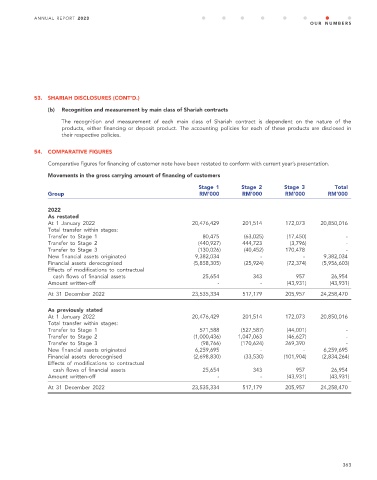

54. COMPARATIVE FIGURES

Comparative figures for financing of customer note have been restated to conform with current year’s presentation.

Movements in the gross carrying amount of financing of customers

Stage 1 Stage 2 Stage 3 Total

Group RM’000 RM’000 RM’000 RM’000

2022

As restated

At 1 January 2022 20,476,429 201,514 172,073 20,850,016

Total transfer within stages:

Transfer to Stage 1 80,475 (63,025) (17,450) -

Transfer to Stage 2 (440,927) 444,723 (3,796) -

Transfer to Stage 3 (130,026) (40,452) 170,478 -

New financial assets originated 9,382,034 - - 9,382,034

Financial assets derecognised (5,858,305) (25,924) (72,374) (5,956,603)

Effects of modifications to contractual

cash flows of financial assets 25,654 343 957 26,954

Amount written-off - - (43,931) (43,931)

At 31 December 2022 23,535,334 517,179 205,957 24,258,470

As previously stated

At 1 January 2022 20,476,429 201,514 172,073 20,850,016

Total transfer within stages:

Transfer to Stage 1 571,588 (527,587) (44,001) -

Transfer to Stage 2 (1,000,436) 1,047,063 (46,627) -

Transfer to Stage 3 (98,766) (170,624) 269,390 -

New financial assets originated 6,259,695 - - 6,259,695

Financial assets derecognised (2,698,830) (33,530) (101,904) (2,834,264)

Effects of modifications to contractual

cash flows of financial assets 25,654 343 957 26,954

Amount written-off - - (43,931) (43,931)

At 31 December 2022 23,535,334 517,179 205,957 24,258,470

363