Page 357 - Bank-Muamalat_Annual-Report-2023

P. 357

ANNUAL REPORT 2023

OUR NUMBERS

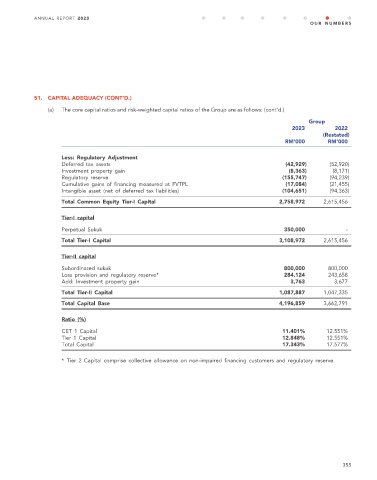

51. CAPITAL ADEQUACY (CONT’D.)

(a) The core capital ratios and risk-weighted capital ratios of the Group are as follows: (cont’d.)

Group

2023 2022

(Restated)

RM’000 RM’000

Less: Regulatory Adjustment

Deferred tax assets (42,929) (52,920)

Investment property gain (8,363) (8,171)

Regulatory reserve (155,747) (94,239)

Cumulative gains of financing measured at FVTPL (17,084) (21,455)

Intangible asset (net of deferred tax liabilities) (104,651) (94,363)

Total Common Equity Tier-I Capital 2,758,972 2,615,456

Tier-I capital

Perpetual Sukuk 350,000 -

Total Tier-I Capital 3,108,972 2,615,456

Tier-II capital

Subordinated sukuk 800,000 800,000

Loss provision and regulatory reserve* 284,124 243,658

Add: Investment property gain 3,763 3,677

Total Tier-II Capital 1,087,887 1,047,335

Total Capital Base 4,196,859 3,662,791

Ratio (%)

CET 1 Capital 11.401% 12.551%

Tier 1 Capital 12.848% 12.551%

Total Capital 17.343% 17.577%

* Tier 2 Capital comprise collective allowance on non-impaired financing customers and regulatory reserve.

355