Page 359 - Bank-Muamalat_Annual-Report-2023

P. 359

ANNUAL REPORT 2023

OUR NUMBERS

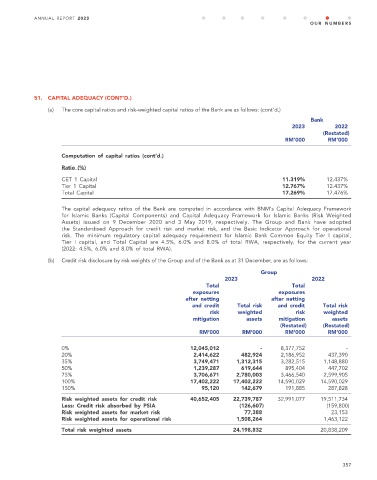

51. CAPITAL ADEQUACY (CONT’D.)

(a) The core capital ratios and risk-weighted capital ratios of the Bank are as follows: (cont’d.)

Bank

2023 2022

(Restated)

RM’000 RM’000

Computation of capital ratios (cont’d.)

Ratio (%)

CET 1 Capital 11.319% 12.437%

Tier 1 Capital 12.767% 12.437%

Total Capital 17.269% 17.476%

The capital adequacy ratios of the Bank are computed in accordance with BNM’s Capital Adequacy Framework

for Islamic Banks (Capital Components) and Capital Adequacy Framework for Islamic Banks (Risk Weighted

Assets) issued on 9 December 2020 and 3 May 2019, respectively. The Group and Bank have adopted

the Standardised Approach for credit risk and market risk, and the Basic Indicator Approach for operational

risk. The minimum regulatory capital adequacy requirement for Islamic Bank Common Equity Tier I capital,

Tier I capital, and Total Capital are 4.5%, 6.0% and 8.0% of total RWA, respectively, for the current year

(2022: 4.5%, 6.0% and 8.0% of total RWA).

(b) Credit risk disclosure by risk weights of the Group and of the Bank as at 31 December, are as follows:

Group

2023 2022

Total Total

exposures exposures

after netting after netting

and credit Total risk and credit Total risk

risk weighted risk weighted

mitigation assets mitigation assets

(Restated) (Restated)

RM’000 RM’000 RM’000 RM’000

0% 12,045,012 - 8,377,752 -

20% 2,414,622 482,924 2,186,952 437,390

35% 3,749,471 1,312,315 3,282,515 1,148,880

50% 1,239,287 619,644 895,404 447,702

75% 3,706,671 2,780,003 3,466,540 2,599,905

100% 17,402,222 17,402,222 14,590,029 14,590,029

150% 95,120 142,679 191,885 287,828

Risk weighted assets for credit risk 40,652,405 22,739,787 32,991,077 19,511,734

Less: Credit risk absorbed by PSIA (126,607) (159,800)

Risk weighted assets for market risk 77,388 23,153

Risk weighted assets for operational risk 1,508,264 1,463,122

Total risk weighted assets 24,198,832 20,838,209

357