Page 239 - Bank-Muamalat_Annual-Report-2023

P. 239

ANNUAL REPORT 2023

OUR NUMBERS

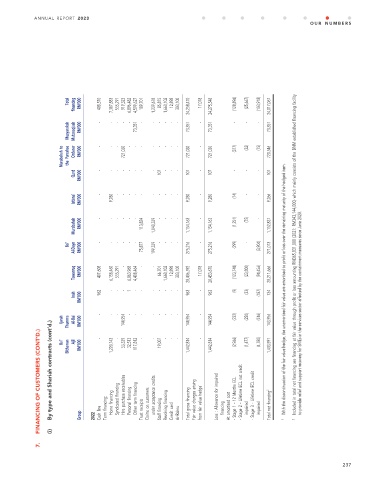

Total financing RM’000 408,570 7,387,883 555,291 919,323 6,896,482 4,599,627 189,701 1,239,678 85,815 1,660,102 12,898 303,100 24,258,470 17,078 24,275,548 (128,896) (25,667) (103,918) 24,017,067

Musyarakah Mutanaqisah RM’000 - - - - - 73,351 - - - - - - 73,351 - 73,351 - - - 73,351

Murabahah to the Purcahse Orderer RM’000 - - - 721,030 - - - - - - - - 721,030 - 721,030 (377) (32) (75) 720,546

Qard RM’000 - - - - - - - - 107 - - - 107 - 107 - - - 107

Istisna’ RM’000 9,280 9,280 9,280 9,266

- - - - - - - - - - - - (14) - -

- - - - - - - - - - - (1,251) (75) -

Murabahah RM’000 113,824 1,040,339 1,154,163 1,154,163 1,152,837

Al-Dayn 75,877 199,339 275,216 275,216 271,013 Included in total net financing are financing at fair value through profit or loss amounting RM365,831,000 (2021: RM343,144,000) which mainly consists of the BNM established financing facility

Bai’ RM’000 (299) (3,904)

- - - - - - - - - - - -

Tawarruq RM’000 407,608 6,158,460 555,291 6,863,968 4,408,464 66,701 1,660,102 12,898 303,100 20,436,592 17,078 20,453,670 (123,748) (23,800) (94,456) 20,211,666

- - -

Inah Thumma Al-Bai RM’000 RM’000 - - - - - 144,954 - - - - - - - - - - 144,954 - 144,954 (232) (250) (516) 143,956 to provide relief and support recovery for SMEs in the services sector affected by the containment measures since June 2020.

962 - - - 1 - - - - - - - 963 - 963 (9) (33) (187) 734 With the discontinuation of the fair value hedge, the unamortised fair value are amortised to profit or loss over the remaining maturity of the hedged item.

Ijarah

FINANCING OF CUSTOMERS (CONT’D.) By type and Shariah contracts (cont’d.) Bai’ Bithaman Ajil RM’000 Cash line Term financing: 1,220,143 Home financing Syndicated financing 53,339 Hire purchase receivables 32,513 Personal financing 117,812 Other term financing Trust receipts Claims on customers - under acceptance credits 19,007 Staff financing - Revolving financing Credit card - Ar-Rahnu 1,442,814 Total gross financ

7. (i) Group 2022 1 2

237