Page 234 - Bank-Muamalat_Annual-Report-2023

P. 234

BANK MUAMALAT MALAYSIA BERHAD

NOTES TO THE

FINANCIAL STATEMENTS

31 DECEMBER 2023 (18 JAMADIL AKHIR 1445H)

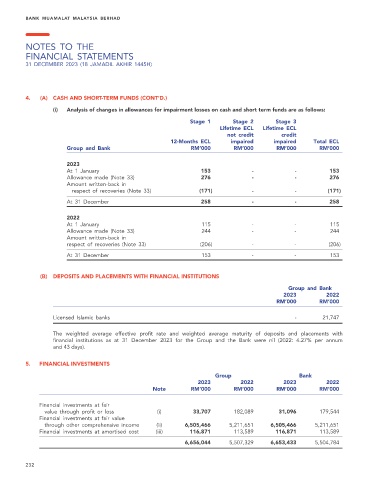

4. (A) CASH AND SHORT-TERM FUNDS (CONT’D.)

(i) Analysis of changes in allowances for impairment losses on cash and short term funds are as follows:

Stage 1 Stage 2 Stage 3

Lifetime ECL Lifetime ECL

not credit credit

12-Months ECL impaired impaired Total ECL

Group and Bank RM’000 RM’000 RM’000 RM’000

2023

At 1 January 153 - - 153

Allowance made (Note 33) 276 - - 276

Amount written-back in

respect of recoveries (Note 33) (171) - - (171)

At 31 December 258 - - 258

2022

At 1 January 115 - - 115

Allowance made (Note 33) 244 - - 244

Amount written-back in

respect of recoveries (Note 33) (206) - - (206)

At 31 December 153 - - 153

(B) DEPOSITS AND PLACEMENTS WITH FINANCIAL INSTITUTIONS

Group and Bank

2023 2022

RM’000 RM’000

Licensed Islamic banks - 21,747

The weighted average effective profit rate and weighted average maturity of deposits and placements with

financial institutions as at 31 December 2023 for the Group and the Bank were nil (2022: 4.27% per annum

and 43 days).

5. FINANCIAL INVESTMENTS

Group Bank

2023 2022 2023 2022

Note RM’000 RM’000 RM’000 RM’000

Financial investments at fair

value through profit or loss (i) 33,707 182,089 31,096 179,544

Financial investments at fair value

through other comprehensive income (ii) 6,505,466 5,211,651 6,505,466 5,211,651

Financial investments at amortised cost (iii) 116,871 113,589 116,871 113,589

6,656,044 5,507,329 6,653,433 5,504,784

232