Page 233 - Bank-Muamalat_Annual-Report-2023

P. 233

ANNUAL REPORT 2023

OUR NUMBERS

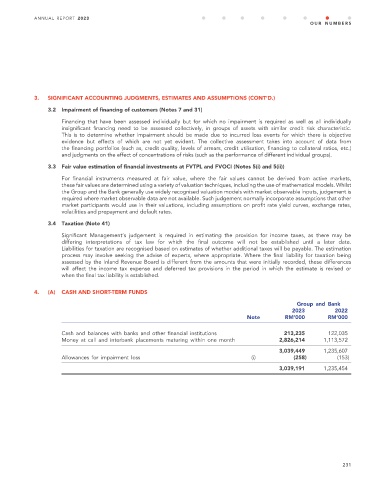

3. SIGNIFICANT ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS (CONT’D.)

3.2 Impairment of financing of customers (Notes 7 and 31)

Financing that have been assessed individually but for which no impairment is required as well as all individually

insignificant financing need to be assessed collectively, in groups of assets with similar credit risk characteristic.

This is to determine whether impairment should be made due to incurred loss events for which there is objective

evidence but effects of which are not yet evident. The collective assessment takes into account of data from

the financing portfolios (such as, credit quality, levels of arrears, credit utilisation, financing to collateral ratios, etc.)

and judgments on the effect of concentrations of risks (such as the performance of different individual groups).

3.3 Fair value estimation of financial investments at FVTPL and FVOCI (Notes 5(i) and 5(ii))

For financial instruments measured at fair value, where the fair values cannot be derived from active markets,

these fair values are determined using a variety of valuation techniques, including the use of mathematical models. Whilst

the Group and the Bank generally use widely recognised valuation models with market observable inputs, judgement is

required where market observable data are not available. Such judgement normally incorporate assumptions that other

market participants would use in their valuations, including assumptions on profit rate yield curves, exchange rates,

volatilities and prepayment and default rates.

3.4 Taxation (Note 41)

Significant Management’s judgement is required in estimating the provision for income taxes, as there may be

differing interpretations of tax law for which the final outcome will not be established until a later date.

Liabilities for taxation are recognised based on estimates of whether additional taxes will be payable. The estimation

process may involve seeking the advise of experts, where appropriate. Where the final liability for taxation being

assessed by the Inland Revenue Board is different from the amounts that were initially recorded, these differences

will affect the income tax expense and deferred tax provisions in the period in which the estimate is revised or

when the final tax liability is established.

4. (A) CASH AND SHORT-TERM FUNDS

Group and Bank

2023 2022

Note RM’000 RM’000

Cash and balances with banks and other financial institutions 213,235 122,035

Money at call and interbank placements maturing within one month 2,826,214 1,113,572

3,039,449 1,235,607

Allowances for impairment loss (i) (258) (153)

3,039,191 1,235,454

231